The trade war between the U.S. and China continues to escalate, with China introducing new policies to block processors of U.S. semiconductor companies Intel (NASDAQ:INTC) and Advanced Micro Devices (NASDAQ:AMD) from being used in government personal computers and servers, the Financial Times reported.

Chinese government agencies have been asked to purchase processors and operating systems that are “safe and reliable.” Interestingly, in late December, China’s Ministry of Industry and Information Technology (MIIT) issued a directive outlining three separate lists of approved technology products developed by domestic Chinese companies only.

China is considered an important market for both Intel and AMD, as they generate a notable portion of their revenues from the country. Thus, both companies could witness significant sales and margin losses due to this move.

Escalating U.S.-China Tensions

The latest development marks Beijing’s growing efforts to reduce its technological reliance on U.S. companies. Additionally, it can be interpreted as a potential response to the expanding list of Chinese entities sanctioned by Washington due to national security concerns.

Last week, the U.S. reportedly considered blacklisting certain Chinese semiconductor companies with ties to Huawei Technologies. These entities include chipmakers Qingdao Si’En, SwaySure, and Shenzhen Pensun Technology Co. (PST).

Meanwhile, China is investing heavily in its technology to ensure that the chip restrictions imposed by the U.S. government do not impact its growth. Earlier this month, Bloomberg reported that China is building a $27 billion chip fund to accelerate the development of advanced technologies.

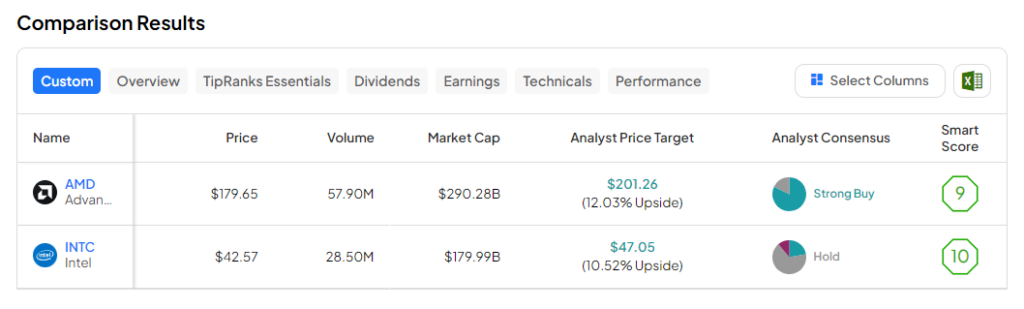

Which Is Better AMD or Intel?

Between AMD and INTC, analysts are optimistic about Advanced Micro Devices stock. It has a Strong Buy consensus rating based on 28 Buys and six Holds. After an impressive rally of 84.5% over the past six months, the analysts’ average price target on AMD stock of $201.26 implies a 12.03% upside potential.