The ongoing U.S.–China chip war has led ASML Holding (NASDAQ:ASML) to stop the delivery of its chip manufacturing machines to China well before the start of the pre-scheduled export ban. ASML is a leading semiconductor company producing lithography systems essential for chip production used in various applications, including AI (Artificial Intelligence).

According to the company, the government has partially revoked the license for shipping NXT:2050i and NXT:2100i lithography systems to China. However, the company pointed out that the current export license setback and the latest U.S. export control restrictions will not significantly impact its financial outlook for 2023.

ASML said it is adhering to all relevant laws and regulations, including export control legislation. Notably, ASML was set to ship three DUV (Deep Ultraviolet) lithography machines to Chinese companies until January, when the full enforcement of new restrictions was anticipated. However, U.S. officials reportedly requested ASML to immediately stop the shipments, Bloomberg reported. With this background, let’s look at the Street’s forecast for ASML stock.

What is the Price Target for ASML Stock?

ASML stock has gained about 39% in value over the past year. This growth reflects management’s upbeat outlook. The company expects its top line to register about 30% growth in 2023. Moreover, its gross margin is projected to show improvement over the prior year.

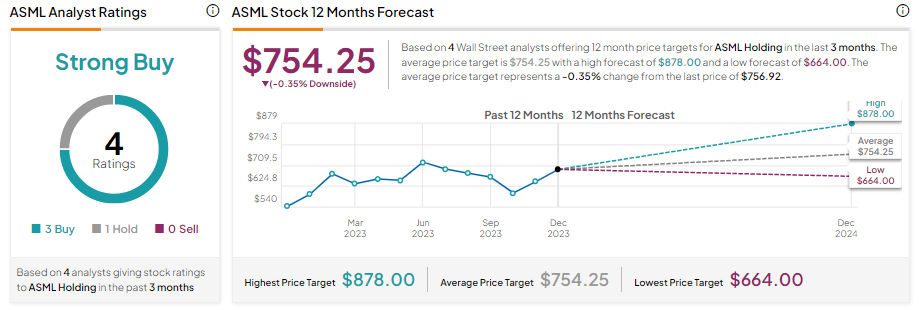

ASML stock sports a Strong Buy consensus rating based on three Buy and one Hold recommendations. However, analysts’ average price target suggests that the positives are already reflected in its current market price. Notably, analysts’ average price target of $754.25 implies a marginal downside potential of 0.35%.