Twitter reported better-than-expected 3Q results as advertising revenue jumped 15%. The social media giant’s sales of $936 million increased 14% year-over-year and came ahead of the Street estimates of $777 million. Third-quarter earnings of $0.19 per share topped analysts’ estimates of $0.06 and grew 11.8% from the year-ago quarter.

Twitter’s (TWTR) monetizable daily active users (mDAUs) increased by 29% to 187 milion year-over-year, falling well short of the consensus estimate of 195 million. In reaction, Twitter stock closed 21.1% lower on Friday.

Twitter’s CFO Ned Segal said that “Advertisers significantly increased their investment on Twitter in Q3, engaging our larger audience around the return of events as well as increased and previously delayed product launches.” (See TWTR stock analysis on TipRanks)

As for 4Q, the company expects advertisers to launch new products on its platform, and for the holiday season to be “accelerated” and “more digital than ever before.” However, the company also warned about uncertainty surrounding the US elections.

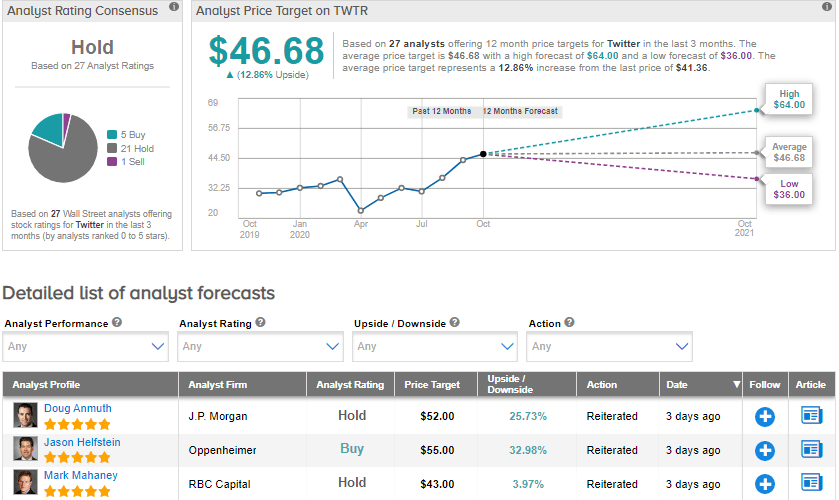

On Oct. 30, J.P. Morgan analyst Doug Anmuth maintained a Hold rating on the stock with a price target of $52 (25.7% upside potential) after the company’s mDAUs missed the Street consensus. Meanwhile, the analyst was impressed with the “strong recovery in brand ads” and he believes that the trend will continue into the fourth quarter.

Like Anmuth, the Street is also sidelined on the stock. The Hold analyst consensus is based on 21 Holds, 5 Buys and 1 Sell. The average price target of $46.68 implies upside potential of about 12.9% to current levels. Shares are up 29.1% year-to-date.

Related News:

Facebook Drops 6% on ‘Uncertain’ 2021 Warning; J.P. Morgan Raises PT

eBay Slips 4% As Online Goods Growth Volume Slows

Pinterest’s Blowout 3Q Sends Shares Up 32%