Twitter, Inc. (NYSE: TWTR) plans to offer senior notes with an aggregate principal amount of $1 billion. The interest on these notes, which are due in 2030, will be payable semi-annually.

The company plans to use the offering’s proceeds for general corporate purposes like strategic transactions, working capital and potential acquisitions, repurchase of common shares, repayment of debt, investments and capital expenditures.

About Twitter

Based out of San Francisco, Twitter is a social networking company that connects a user to a network of people, ideas, news, opinions and information.

TWTR stock closed 0.5% down on Wednesday. It lost another 1.1% in the extended trading session to end the day at $32.41.

Wall Street’s Take

Recently, Brian Fitzgerald from Wells Fargo (NYSE: WFC) maintained a Hold rating on the stock with a price target of $42 (28.2% upside potential).

Additionally, Morgan Stanley (NYSE: MS) analyst Brian Nowak reiterated a Hold rating on Twitter and raised the price target from $57 to $59 (80.1% upside potential).

Overall, the stock has a Hold consensus rating based on 8 Buys, 17 Holds and 2 Sells. The average TWTR price target of $46.85 implies 43% upside potential. Shares have lost 52.3% over the past six months.

Website Traffic

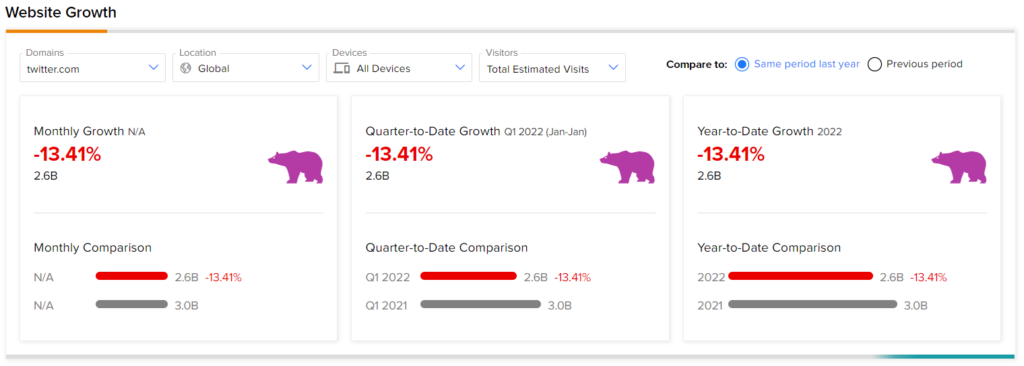

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (NYSE: SEMR), the world’s biggest website usage monitoring service, offers insight into Twitter’s performance.

According to the tool, compared to the previous year, Twitter’s website traffic registered a 13.4% decline in global visits year-to-date.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Bath & Body Slips 3.4% Despite Strong Q4 Results

Apollo Funds to Acquire Tenneco for $7.1B; Shares Surge 94%

Cloudflare to Acquire Area 1 Security for $162M; Shares Sink 1%