Twitter (TWTR) has launched a verification application process allowing anyone to apply for the coveted blue checkmark. The new application process marks an important milestone in the company’s push to enhance transparency and credibility in the network.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

To make the grade for the blue badge, users will have to meet some requirements, including having an account of public interests. An account must be complete with a profile name, profile image, and either confirmed email address or phone number for verification. It also must have been active the last six months

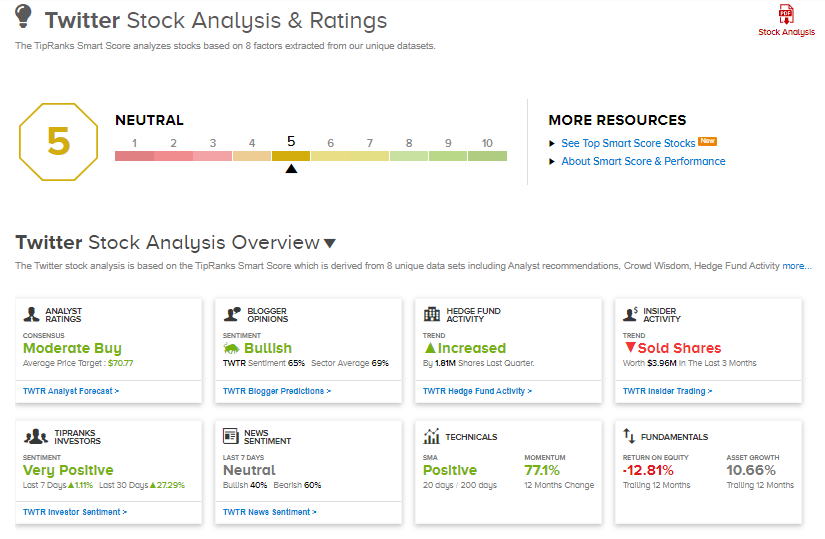

Some of the categories of accounts eligible for verification include government, companies, brands, and organizations, while activists, organizers, and other influential individuals can also apply for verification. (See Twitter stock analysis on TipRanks).

“The blue badge is one of the ways we help people distinguish the authenticity of accounts that are of high public interest. It gives people on Twitter more context about who they’re having conversations with so they can determine if it’s trustworthy, which our research has shown leads to healthier, more informed conversations.,” Twitter said in a blog post.

Those looking to apply for verification can do so through the Account Settings tab and should expect a response within a few days. Once an application is approved, the blue checkmark badge will appear on the profile automatically.

The relaunch of the verification process comes months after Twitter started enforcing a new policy that automatically removes the verified badge from some accounts. Some of the affected accounts that no longer meet the updated verification criteria include those with incomplete profiles or have been inactive for some time.

Three weeks ago, KeyBank analyst Justin Patterson reiterated a Buy rating on the stock but cut the price target to $77 from $90 implying 40.74% upside potential to current levels. The cut came on Twitter’s Q1 results and Q2 forecasts lagging those of its peers.

Patterson stated, “We believe results lagged because direct response products are still nascent and 1Q had brand spend noise. With product updates rolling out over the course of 2021, we believe there are catalysts ahead.”

Consensus among analysts on Wall Street is a Moderate Buy based on 10 Buy, 18 Hold, and 1 Sell ratings. The average analyst price target of $70.77 implies 29.35% upside potential to current levels.

TWTR scores a 5 out of 10 on TipRanks’ Smart Score rating system, implying its performance is likely to align with market expectations.

Related News:

Walmart Partners with Western Union to Enable Cross-Border Transfers

JetBlue Introduces Lower Fares into Transatlantic Air Travel Market

IBM Acquires Waeg to Bolster Its Salesforce Business in Europe