Twitter (TWTR) has finally introduced its tipping feature following reports circulating about it last week. The social media company introduced its Tip Jar feature yesterday that will allow people to tip other users for tweets that they like. TWTR said that a profile enabled with this feature will have a Tip Jar icon on the profile page.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Twitter explained, “Tap the icon, and you’ll see a list of payment services or platforms that the account has enabled. Select whichever payment service or platform you prefer and you’ll be taken off Twitter to the selected app where you can show your support in the amount you choose.”

The company said that users could tip for tweets that they liked through Patreon, PayPal (PYPL), Cash App (SQ), Bandcamp, and Venmo. TWTR won’t be taking any share of the money through this feature. On the Android platform, users can send tips through Spaces.

TWTR also said that from May 6, the company’s English-speaking users can send tips to a particular user group on the iOS and Android platforms. For now, the company has made the Tip Jar feature available to a group of users that includes experts, non-profits, journalists, and creators. (See Twitter stock analysis on TipRanks)

The company intends to expand this feature to users in other languages and other groups of users at a later stage.

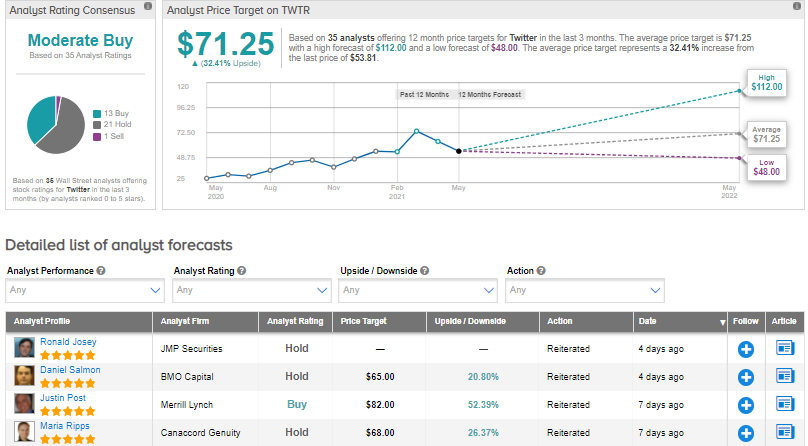

Om May 3, JMP Securities analyst Ronald Josey reiterated a Hold rating on the stock. Josey said in a note to investors, “A key differentiator of Twitter to its core online ad platform peers is that currently 85% of its ad revenue is brand specific. Management is committed to balancing brand and DR [direct response] ad revenue to a 50/50 split over time and this focus should ultimately help to minimize brand ad spend turbulence (as experienced this quarter with the Capitol riots) while exposing the platform to higher growth performance and DR budgets, verticals (like eCommerce), and a greater number of advertisers.”

Overall, consensus among analysts is a Moderate Buy based on 13 Buys, 21 Holds, and 1 Sell. The average analyst price target of $71.25 implies upside potential of 32.4% from current levels.

Related News:

Fastly Reports Disappointing 1Q Results, Light Outlook, CFO Exit; Shares Fall 17.5%

Roku Reports Profit In 1Q As Results Beat Estimates; Shares Pop 9%

Verizon To Sell Media Business To Apollo Management For $5B But Will Retain 10% Stake