Concluding the world’s richest person Elon Musk and the Twitter saga, the social networking company Twitter, Inc. (NYSE: TWTR) has inked a deal with Tesla (NASDAQ: TSLA) CEO Elon Musk to be acquired in a cash deal valued at $44 billion.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts and uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Shares of Twitter closed 5.66% higher on Monday, while Tesla shares remained almost flat.

Terms of the Agreement

Per the terms of the deal, Musk will pay $54.20 in cash for each share of Twitter common stock. The price tag represents a 38% premium to the TWTR’s closing price on April 1, 2022, the last trading day after which Musk’s 9.2% stake in Twitter was disclosed publicly.

The leveraged buyout deal will be funded by $25.5 billion in secured debt and margin loan financing, while $21 billion will be invested as equity by Musk.

The transaction, which has received Twitter Board approval but awaits shareholder approval and certain regulatory approvals, is expected to close in 2022. After closure, Twitter will become a private company.

Official Comments

Twitter’s Independent Board Chair, Bret Taylor, said, “The Twitter Board conducted a thoughtful and comprehensive process to assess Elon’s proposal with a deliberate focus on value, certainty, and financing. The proposed transaction will deliver a substantial cash premium, and we believe it is the best path forward for Twitter’s stockholders.”

Post announcement of the deal, encouragingly, Musk said, “Free speech is the bedrock of a functioning democracy, and Twitter is the digital town square where matters vital to the future of humanity are debated. I also want to make Twitter better than ever by enhancing the product with new features, making the algorithms open source to increase trust, defeating the spam bots, and authenticating all humans.”

Wall Street’s Take

Following the announcement of the deal, Wells Fargo analyst Brian Fitzgerald reiterated a Hold rating on Twitter but lifted the price target to $54.2 (4.84% upside potential) from $42.

Remaining skeptical about Twitter getting a competing offer for the acquisition, Fitzgerald anticipates that “the deal will achieve shareholder approval, and anticipate a relatively quick transaction close,” as he believes the deal to be free from significant regulatory hassles.

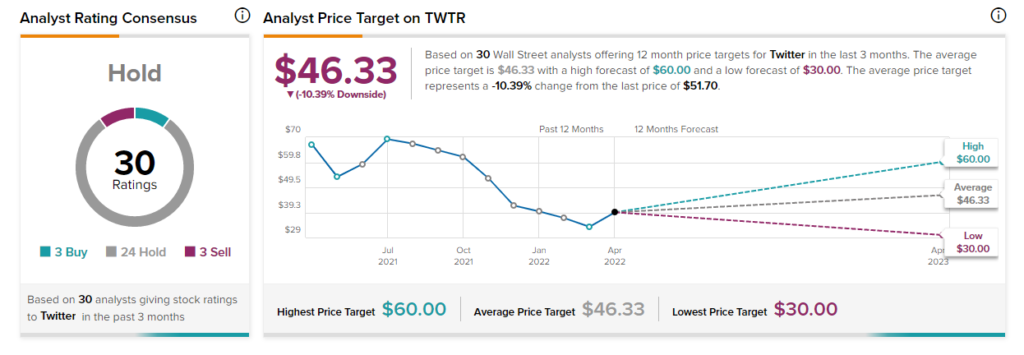

Overall, the stock has a Hold consensus rating based on three Buys, 24 Holds, and three Sells. The average Twitter stock forecast of $46.33 implies 10.39% downside potential to current levels. Shares have decreased 22.51% over the past year.

Website Traffic

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (NYSE: SEMR), offers insight into Twitter’s performance in the to-be-reported quarter.

According to the tool, a website traffic uptrend is visible. In the first quarter of 2022, total estimated visits to twitter.com showed an increasing trend, on a global basis, representing a 2.34% sequential rise, and a significant year-over-year rise of 207.53%. This, in turn, indicates that the company might report strong revenues in the first quarter (scheduled to report on April 28).

Concluding Remarks

With a series of plans and ideas to improve the Twitter platform, used by millions of individuals, Elon Musk is expected to give the public social media platform a new direction. Amid challenges faced by the company, the deal is expected to be a ray of hope to keep the momentum alive for the platform, with transformational moves providing decent value to shareholders.

Learn more about the Website Traffic tool in this video by Youtube sensation Tom Nash.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure

Related News:

NextEra Energy: Mixed Quarterly Results, Price & Supply Issues Continue

Intuitive Surgical Posts Quarterly Beat; Shares Drop

Twitter Faces Jack Dorsey’s Criticism