Even after ending the Twitter, Inc. (NYSE: TWTR) saga with the announcement of a definitive cash deal worth $44 billion to acquire the social networking company, the world’s richest person, Elon Musk, is entangled in public discussions. A plethora of public opinions are speculating on the reasons for the deal and its repercussions.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

For Tesla (TSLA) CEO Elon Musk, the Twitter deal is not just a financial transaction. He considers the platform to be used for free speech, and that Twitter is “the digital town square where issues vital to the future of humanity are debated,” as posted by Musk.

According to Musk, though Twitter is facing challenges currently, the platform has massive potential to succeed through proper transformation, including policy changes and other initiatives. Though not publicly disclosed, Musk is likely to revamp the advertising-focused business model of the company, once the buyout completes.

Speculation is ongoing in the market that Musk has been tempted by his fellow billionaires and internet controversialists to take Twitter private. Twitter co-founder Jack Dorsey, who stepped down from the position of CEO in November but remains a Board director, is expected to be among these.

“Elon is the singular solution I trust,” Mr. Dorsey tweeted on April 25, after Musk’s offer was accepted by Twitter. “I trust his mission to extend the light of consciousness,” he added.

Interestingly, following the deal, Musk offloaded shares of Tesla worth $8.5 billion, according to the Securities and Exchange Commission (SEC) filings. It is believed that Musk is selling shares to arrange for his finances committed to the leveraged buyout deal of Twitter.

Twitter’s Earnings Snapshot

Recently, Twitter reported better-than-expected Q1 earnings of $0.90 per share, significantly beating analysts’ estimates of $0.03 per share and up from $0.16 per share over the same quarter last year. Meanwhile, revenues jumped 16% year-over-year to $1.2 billion but missed consensus estimates of $1.22 billion. Advertising revenues grew 23% year-over-year to $1.11 billion, while average monetizable daily active users (mDAU) increased 15.9% to 229 million during the quarter.

Price Performance

Shares of Twitter jumped by 27% on April 4 to $49.97, following Musk’s stake disclosure. Since then, it is trading above $40, with almost stable price action post-deal.

Wall Street’s Take

Following Q1 results, Truist Financial analyst Youssef Squali reiterated a Hold rating and a price target of $50 (2% upside potential) on Twitter.

Squali reported, “We believe softness on the top-line was likely due to a myriad of factors: 1) a pullback in ad spend, particularly in Europe, from the Russia/Ukraine conflict and global supply chain issues, 2) FX headwinds from geopolitical uncertainty and unrest.”

Adding a third reason, the analyst attested that because “TWTR skews heavier towards brand advertising vs. DR, Apple’s ATT. Twitter will face tough comps in 2Q and 3Q as the company laps high growth periods over 2020’s relatively muted results.”

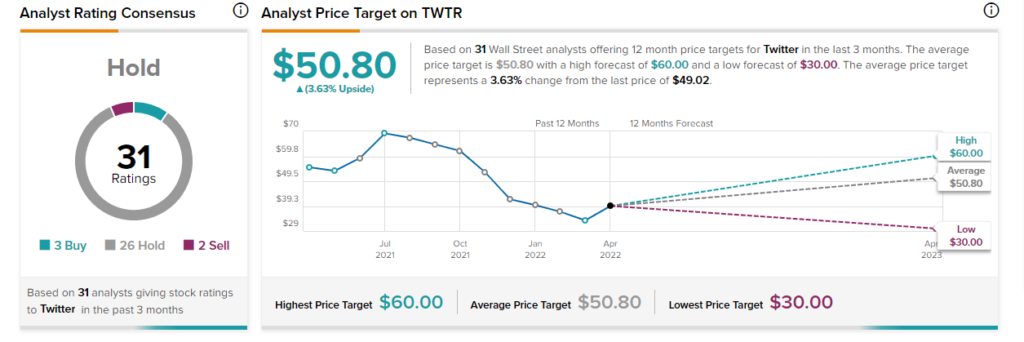

Overall, the stock has a Hold consensus rating based on three Buys, 26 Holds, and two Sells. The average Twitter stock forecast of $50.80 implies 3.63% upside potential to current levels.

Website Traffic

TipRanks’ Website Traffic Tool which uses data from SEMrush Holdings (SEMR) offers insight into Twitter’s performance.

According to the tool, a website traffic uptrend was visible. In Q1 2022, total estimated visits on twitter.com showed an increasing trend, on a global basis, representing a 2.34% jump from the fourth quarter and a 207.53% rise on a year-over-year basis.

The predictions that were based on TipRanks’ website visits data turned out to be correct, with Twitter reporting a rise in mDAU in Q1 2022.

Learn more about the Website Traffic tool in this video by Youtube sensation Tom Nash.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure

Related News:

Unilever Scathed as Inflation Hits Consumer Goods Sector

Moderna Seeks EUA to Vaccinate Young Children with mRNA-1273

Qualcomm Stock Rises on Upbeat Q2 Results, Strong Outlook