Shares of Twilio surged 7.7% on Monday after the company said that it is buying customer data platform startup Segment for $3.2 billion in stock. The board of directors of both Twilio and Segment have approved the deal.

Twilio (TWLO) expects the deal to be completed in the fourth quarter of 2020. The cloud communications company said that the transaction will boost its growth and provide the company with a combined total addressable market of $79 billion.

Twilio’s CEO Jeff Lawson said that the combination of Segment and Twilio’s customer engagement platform “can create more personalized, timely and impactful engagement across customer service, marketing, analytics, product and sales.” (See TWLO stock analysis on TipRanks).

Following the announcement of the acquisition, FBN Securities analyst Shebly Seyrafi raised the stock’s price target to $360 (9.2% upside potential) from $340 and maintained a Buy rating.

Seyrafi said that Segment is “recognized as a clear leader in CDP [customer data platform]” and the deal should be accretive to Twilio’s revenue growth. He also believes that the Segment’s CDP along with Twilio’s customer engagement platform would significantly improve customer experience.

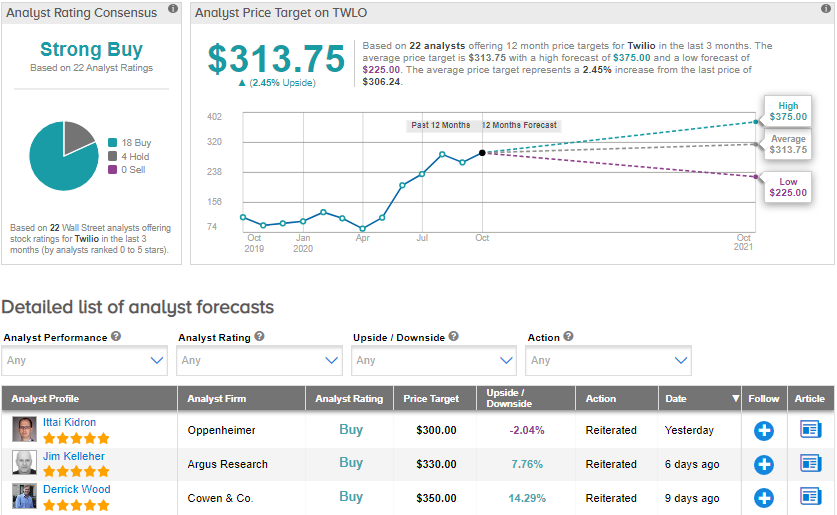

Currently, the Street is bullish on the stock. The Strong Buy analyst consensus is based on 18 Buys and 4 Holds. Given the year-to-date share price rally of 235.5%, the average price target of $313.75 implies upside potential of about 2.5% to current levels.

Related News:

Twilio To Top 3Q Sales Fueled By Cloud Demand; Shares Surge 10%

Bandwidth Snaps Up Voxbone In $527M Cloud Communications Deal; Shares Rise 4%

Wix Teams Up With Vodafone For UK Expansion; Shares Now Up 138% YTD