Tupperware Brands has nabbed $275 million in term loans in a move to improve its capital structure and refinance senior debt maturing in June 2021.

Tupperware (TUP) has entered into a commitment letter with a number of investment entities, including JPMorgan Chase Bank, for two term loan facilities for an aggregate principal amount of $275 million. The food storage products maker intends to use the proceeds from the term loan facilities and cash on hand to redeem all of its outstanding senior notes in the aggregate principal amount of $380.2 million and to pay related fees and expenses.

Following the successful execution of the transaction, Tupperware won’t have any debt maturing until the fourth quarter of 2023. The company has in recent months been working on turnaround plans to drive sales growth. As part of the plan, the company is switching to digital tools to boost sales, while also implementing cost reductions to improve profitability.

“Top priorities associated with the turnaround plan have been to right-size the business, improve liquidity and strengthen our balance sheet to improve our capital structure,” said Tupperware CFO Sandra Harris. “We are very pleased today to announce that we have successfully executed a commitment for $275 million, which combined with our improvement in operating cash flow, allows us to retire all Senior Notes. We believe that this transaction will satisfactorily remediate the relevant conditions that led to the going concern doubt disclosure in our two most recent quarterly financial reports.”

The closing of the term loan facilities and related redemption of the senior notes is expected in the fourth quarter of 2020.

TUP shares have surged 39% over the past 5 days after the company’s third-quarter profit and revenue blew past the Street consensus estimates. Adjusted earnings per share surged to $1.20 from $36 cents, exceeding analysts’ expectations of 37 cents. Sales gained 14% to $477.2 million, surpassing the consensus estimate of $362.8 million.

Tupperware CEO Miguel Fernandez said sales growth was fueled by “rapid adoption of digital tools by our sales force to combat the social restrictions surrounding COVID-19, and the increased consumer demand for our innovative and environmentally friendly products, as more consumers cook at home and are concerned with food safety and storage.”

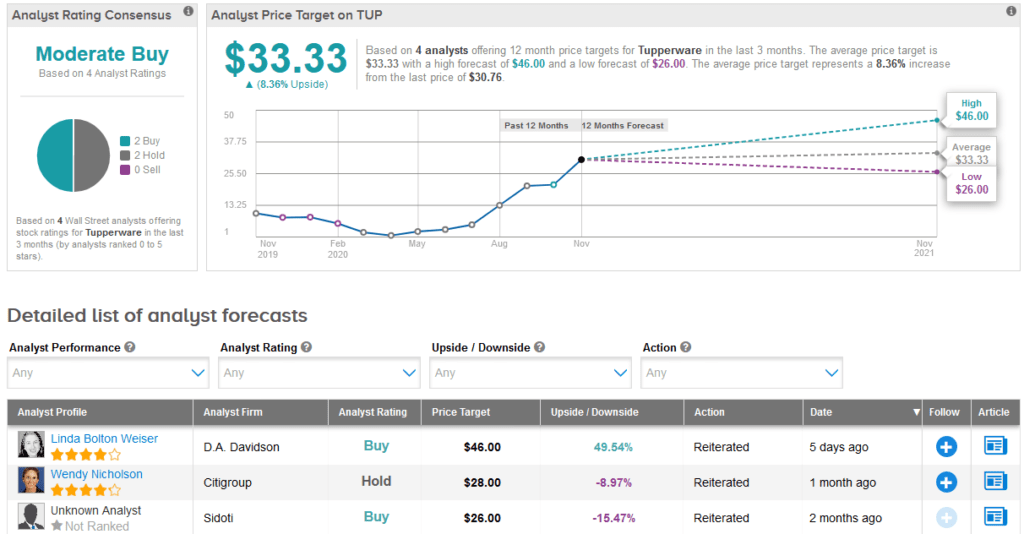

Citigroup analyst Wendy Nicholson recently almost doubled the stocks’s price target to $28 from $15 amid optimism about the execution of the company’s turnaround plan. However, Nicholson maintained a Hold rating as she expects the stock to continue to be volatile.

The analyst added that the visibility of sales and earnings growth is still “very low” given that the turnaround is in the early stages. (See TUP stock analysis on TipRanks).

Overall, TUP scores a Moderate Buy consensus as analysts are evenly divided, with 2 Buy ratings and 2 Hold ratings assigned. With shares up a whopping 258% year-to-date, the average price target of $33.33 implies upside potential of another 8.4% to current levels.

Related News:

Twitter Board Confident In Leadership Structure Post Review; Shares Rise

SolarEdge Sinks 16% In Pre-Market On Disappointing Sales Outlook

Clorox Hikes 2021 Guidance Due To Cleaning Bonanza; Shares Rise 4%