Shares of video game developer Take-Two Interactive (TTWO) have been under pressure in recent months. This is partly due to subtle industry headwinds, project cancellations, and a sweeping round of layoffs (around 600 staff affected), among other concerns that have some hitting the pause button. After the latest losing streak, TTWO stock is down 19% from 52-week highs and 35% from its 2021 all-time high. Despite the ugly technical backdrop (double-top chart pattern) and a lack of timely catalyst until the launch of Grand Theft Auto VI (GTA VI), I remain bullish on the name for the long haul and believe the latest plunge presents a buying opportunity.

This optimism stems from the anticipation surrounding GTA VI, which is poised to be a significant catalyst, as well as Take-Two’s strategic focus on optimizing its operations (cost-cutting) and strengthening its mobile gaming segment.

Take-Two Trims Away at the Budget

Though cutting 5% of the workforce does not inspire confidence as we move ever so closer to GTA VI’s arrival, it’s worth noting that recent job cuts (in an effort to streamline operations) have primarily affected various other less-ambitious titles.

Though specifics weren’t disclosed, it seems likely that smaller-budget projects were affected by the cuts. After all, the massive gaming firm has more than just GTA VI in its stacked pipeline, even though many investors and analysts only want to hear about progress on the looming blockbuster.

Notably, Take-Two has around 18 mobile games in development. Given the hit-or-miss nature of such mobile titles, I’d be surprised if the mobile development pipeline didn’t feel the brunt of the latest cost cuts.

Either way, GTA fans can breathe easy. Further, Take-Two is definitely not the only tech or gaming firm cutting costs and conducting layoffs recently. Amid a challenged consumer and higher rates, such unfortunate conditions have really become the norm. As such, you can’t really fault Take-Two for strategic reductions as the firm concentrates on its heavier hitters going into 2025.

Take-Two Stock Gets a Huge Vote of Confidence from Big Bull on Wall Street

Take-Two stock trended higher, at least momentarily, last month when news broke that Jefferies analyst James Heaney named TTWO stock one of his firm’s top picks. Undoubtedly, Heaney is quite a big bull on video game stocks in general these days. Still, he’s particularly upbeat when it comes to GTA VI, a once-in-a-decade type of catalyst that could singlehandedly take TTWO stock to new levels.

Sure, it’s common knowledge that GTA VI is on the horizon. However, the length and lack of action in the years leading up to the launch have been a true test of investor patience.

Though the recent past may be somewhat underwhelming, the near future could see a drastic ramp-up in hype. Specifically, Heaney praised Take-Two for sporting the “most visible path to its many release catalysts, headlined by GTA VI and return to growth in mobile.”

He’s right. GTA VI is the star of the show, but let’s not forget about the slew of mobile titles that can function as a very good supporting act.

As noted previously, the company had about one and a half dozen mobile games in the pipeline. While some may never see the light of day, I think the odds of a few really hitting the spot are quite high. After all, mobile gaming is a fast-growing segment of video gaming. And Heaney thinks Take-Two is slated to enjoy “regained momentum” over the medium term.

Further, Take-Two has a shining gem in the mobile scene with Zynga, a firm that’s a pioneer of sorts when it comes to addictive mobile games (think Farmville).

Grand Theft Auto VI: Don’t Discount Its Potential

Take-Two may be somewhat tough to value right here, as one of its most epic catalysts to date is right around the corner. That said, shares look too cheap at just 4.6 times price-to-sales (P/S), even against the lower 3.9 times of the electronic gaming and multimedia industry average. Sure, TTWO shares go for a slight premium, but I’d argue they deserve a huge premium, given the potential for GTA VI to help TTWO stock level up the firm’s earnings growth.

Indeed, it’s been close to nine months since the first GTA VI trailer blew fans away. The wait has been rather long. But once it lands, the likely blockbuster may very well take to the top of the gaming charts and stay there for the long haul, much like other live-service games (think Fortnite) have many years after their initial release.

Should Take-Two be able to effectively monetize the title (I think it will), perhaps it can expand its margins in a big way, all while keeping users engaged with constant content updates to keep things feeling fresh.

Is TTWO Stock a Buy, According to Analysts?

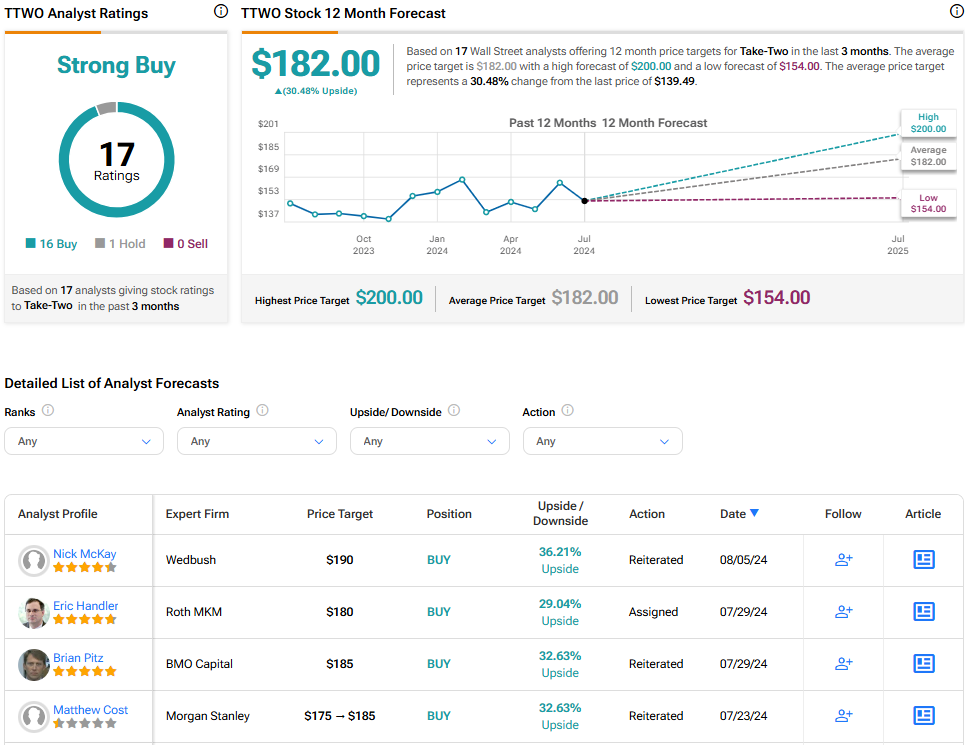

On TipRanks, TTWO stock comes in as a Strong Buy. Out of 17 analyst ratings, there are 16 Buys and one Hold recommendation. The average TTWO stock price target is $182.00, implying upside potential of 30.5%. Analyst price targets range from a low of $154.00 per share to a high of $200.00 per share.

The Takeaway

Take-Two stock seems like a dormant bear right now, but it will be coming out of hibernation very soon with the release of GTA VI. Moreover, a strong mobile pipeline and streamlined operations could help the firm reaccelerate growth over the medium term. All things considered, investors may wish to give the name a second look after the latest pullback before the firm emerges from its lengthy slumber.