Tyson Foods (NYSE:TSN) announced mixed fiscal second-quarter results, with adjusted earnings of $0.62 per share compared to a loss of $0.04 per share in the same period last year. This surpassed analysts’ expectations of earnings of $0.36 per share.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The meatpacking company’s sales declined slightly by 0.46% year-over-year in the second quarter to $13.07 billion, compared to Street estimates of $13.06 billion.

Tyson Foods’ Moves to Cut Costs

Tyson Foods has undertaken comprehensive steps to rein in costs and improve operational efficiency. Earlier this year, the company permanently closed its pork plant in Perry, Iowa, resulting in the elimination of 1,200 jobs. Over the past year, TSN has also closed six chicken plants in four U.S. states and implemented layoffs among corporate employees.

The company has faced challenges in its chicken, beef, and pork segments. Lower commodity prices are affecting its chicken business, while tight supply has raised cattle costs for the beef segment. Additionally, the company’s pork segment has struggled with internal production issues, higher feed costs, and margin compression.

TSN’s FY24 Outlook

In FY24, the company stated that the United States Department of Agriculture (USDA) has predicted that domestic production of protein (including beef, pork, chicken, and turkey) should “increase slightly” year-over-year. However, TSN expects its sales to remain “relatively flat” year-over-year, with adjusted operating income likely to range between $1.4 billion and $1.8 billion.

Is TSN a Buy or Sell?

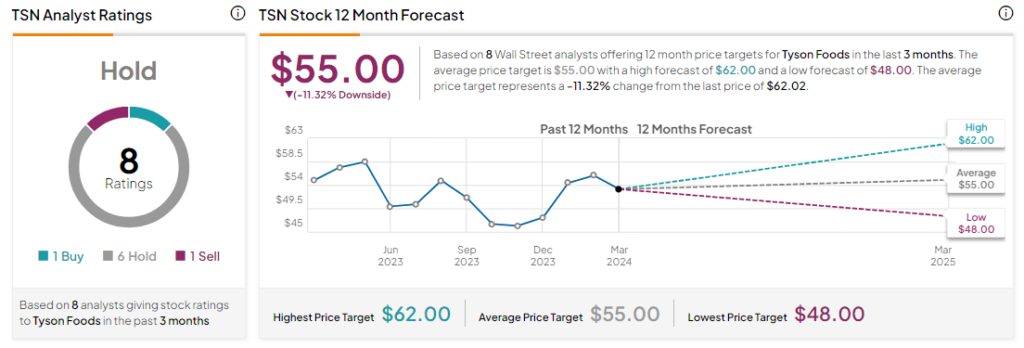

Analysts remain sidelined about TSN stock, with a Hold consensus rating based on one Buy, six Holds, and one Sell. Over the past year, TSN has increased by more than 25%, and the average TSN price target of $55 implies a downside potential of 11.3% from current levels. These analyst ratings will likely change following TSN’s Fiscal Q2 results today.