Shares of Tesla (NASDAQ:TSLA) are down at the time of writing after Morgan Stanley downgraded the EV stock from Buy to Hold, arguing that the electric vehicle giant’s stock is now fairly priced after a recent surge powered by AI excitement. Nevertheless, they also increased their base case price target on Tesla from $200 to $250, while bear and bull case valuations were raised to $90 (from $70) and $450 (from $390), respectively. In terms of earnings, Morgan Stanley’s team set a 2023 EPS estimate for Tesla at $3.03, falling short of the consensus forecast of $3.33. This is the second downgrade in two days after Barclays cut TSLA to Hold yesterday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Despite acknowledging the temptation for investors to capitalize on the current positive momentum, Adam Jonas pointed out that Tesla’s share price vastly exceeds the company’s standing as just a leading EV manufacturer. He also cautioned about over-enthusiasm for AI-related stocks and reminded investors about the distinct differences between autonomous driving technology and generative AI.

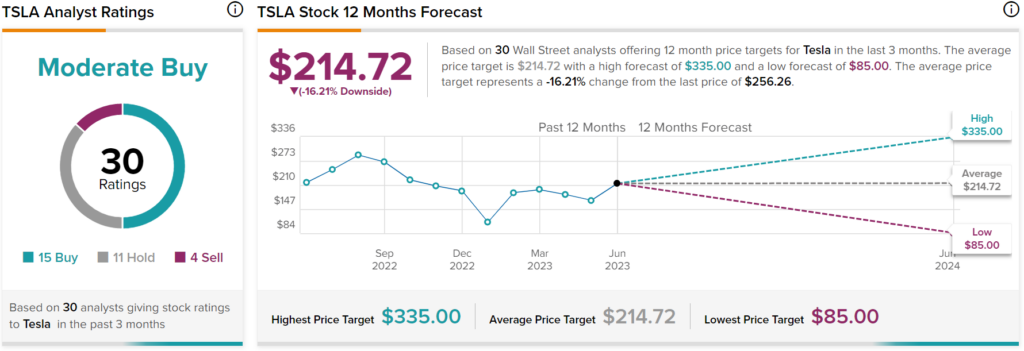

Overall, analysts have a Moderate Buy consensus rating on TSLA stock based on 15 Buys, 11 Holds, and four Sells assigned in the past three months, as indicated by the graphic above. Nevertheless, the average price target of $214.72 per share implies 16.21% downside potential.