The year 2024 has presented a challenging start for electric vehicle (EV) giant Tesla (NASDAQ:TSLA) shareholders, with the stock witnessing a decline of over 22% year-to-date. Adding to its challenges, the company is facing obstacles in expanding its manufacturing plant in Germany. Also, a price war among automakers is intensifying, putting pressure on TSLA’s margins and its share price.

Per a Reuters report, Tesla’s initiative to expand its German manufacturing facility encounters challenges, with citizens voting against clearing the forest for the larger site. Notably, Tesla plans to double the plant’s capacity to 100 gigawatt hours of battery production and 1 million cars per year. This move should strengthen its competitive positioning in the European EV market.

In other news, Ford Motor Company (NYSE:F) has announced a reduction in the price of its 2023 Mustang Mach-E, with discounts ranging from $3,100 to a maximum of $8,100. This strategic move by Ford is expected to stimulate sales growth and escalate competition, forcing Tesla and other companies to lower prices at the cost of their margins.

Is Tesla a Buy or Sell Now?

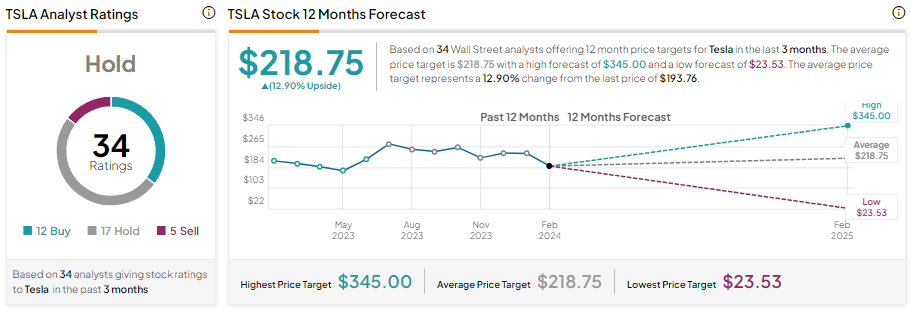

Wall Street analysts are sidelined on Tesla stock given the near-term volume and margin headwinds. It has 12 Buy, 17 Hold, and five Sell recommendations for a Hold consensus rating. Analysts’ average price target of $218.75 implies a limited upside potential of 12.9% from current levels.