Shares of Tesla (NASDAQ:TSLA) fell in after-hours trading after the company reported earnings for its first quarter of Fiscal Year 2023. Earnings per share came in at $0.85, which slightly missed analysts’ expectations of $0.86. Sales increased by 24.2% year-over-year, with revenue hitting $23.3 billion. This missed analysts’ expectations of $23.36 billion.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Tesla revealed that its capex figure came in at $2.07 billion for the quarter, up significantly compared to its previous quarter’s figure of $1.86 billion. Tesla also noted that its free cash flow had fallen nearly two-thirds, going from $1.42 billion in the fourth quarter of 2022 to $441 million in this quarter. However, Tesla also beat delivery expectations, bringing out 422,875 cars.

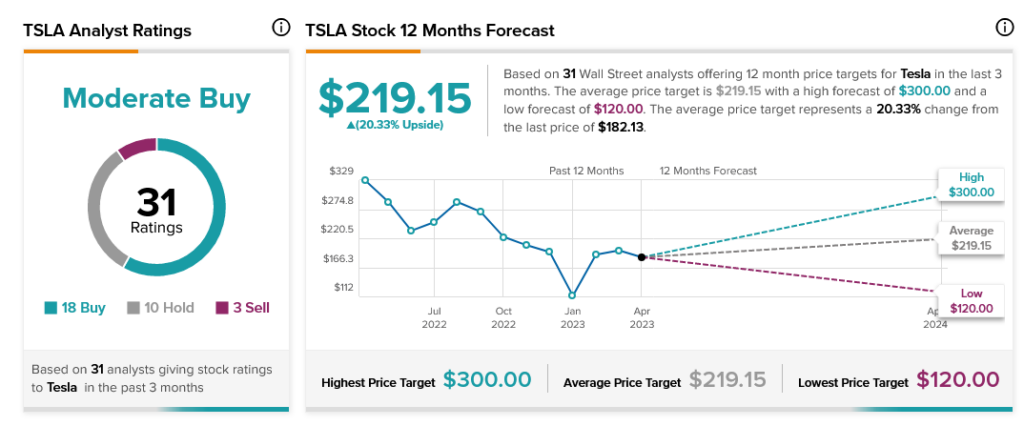

Overall, Wall Street has a consensus price target of $219.15 on Tesla, implying 20.33% upside potential, as indicated by the graphic above.