Shares of electric vehicle (EV) companies Tesla (NASDAQ:TSLA) and Rivian (NASDAQ:RIVN) saw significant gains on Tuesday, July 2. Tesla stock closed up 10.2%, while Rivian’s rose by 7%. This jump came after both companies reported stronger-than-expected vehicle deliveries for the second quarter. Despite the positive Q2 delivery numbers, both Tesla and Rivian face challenges ahead.

Thanks to the jump in Tesla stock, the NASDAQ 100 Index (NDX) and the S&P 500 (SPX) closed higher.

Strong Q2 Deliveries, But Challenges Persist

Tesla delivered 443,956 units in Q2, exceeding the consensus estimates of 436,000 vehicles. However, Q2 marks the second consecutive quarter of year-over-year declines in deliveries. Meanwhile, Rivian produced 9,612 vehicles and delivered 13,790 units in Q2.

However, demand for EVs has slowed due to persistently high interest rates. Additionally, increased competition and a price war in the sector will likely weigh on their profitability.

Here’s What Analysts Think About TSLA Stock

Goldman Sachs analyst Mark Delaney reiterated a Hold rating on TSLA stock despite better-than-expected Q2 deliveries. The analyst sees challenging near-term market conditions for the company. Moreover, he views TSLA stock’s valuation as well-balanced near the current market price.

Echoing similar sentiments, TD Cowen analyst Jeff Osborne also maintained a Hold rating on TSLA stock following its upbeat Q2 deliveries.

Rivian Faces Similar Hurdles

While no immediate analysts’ reactions followed Rivian’s Q2 deliveries, it is not immune to the broader sector challenges.

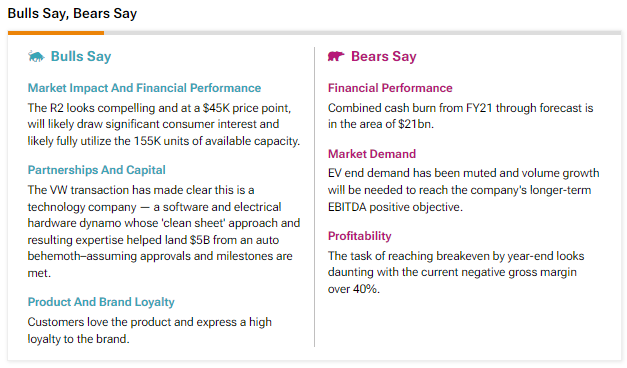

According to the TipRanks Stock Analysis tool, “Bulls Say, Bears Say,” analysts bearish on Rivian stock highlight muted EV demand and the need for volume growth to achieve long-term financial goals. Rivian is also facing cash burn issues, and with ongoing price competition in the sector, reaching breakeven remains a significant challenge.

Is Tesla a Buy, Sell, or Hold?

Wall Street analysts are sidelined on Tesla stock. With 12 Buys, 14 Holds, and eight Sell recommendations, Tesla stock has a Hold consensus rating. The price target for TSLA stock is $182.82, implying 20.95% downside potential from current levels.

Is Rivian a Buy, Sell, or Hold?

Analysts are cautiously optimistic about Rivian stock. With 12 Buys, eight Holds, and two Sell recommendations, Rivian stock has a Moderate Buy consensus rating. The price target for RIVN stock is $16.85, implying 13.16% upside potential from current levels.