Stocks of electric vehicle (EV) makers Tesla (NASDAQ:TSLA), Rivian (NASDAQ:RIVN), and Fisker (NYSE:FSR) all ended Monday in red, down nearly 5%, 2%, and 9%, respectively. Wondering what pulled these major stocks down? Well, a disappointing outlook from the automotive chip maker ON Semiconductor (NASDAQ:ON) due to weakening EV demand spooked investors.

Yesterday, onsemi reported better-than-expected third-quarter results. However, the company’s weak Q4 revenue outlook resulted in ON stock’s decline of about 22%. The company said that demand from certain European automotive customers remains low as they are adjusting their inventory levels. Further, ON warned about the impact of high interest rates on auto demand. Higher rates generally deter consumers from buying or leasing vehicles.

For the fourth quarter, onsemi has guided adjusted revenues in the range of $1.95 billion to $2.05 billion and adjusted earnings between $1.13 and $1.27 per share. These estimates are below the expert consensus of $1.36 per share in earnings and $2.18 billion in sales.

It is worth mentioning that onsemi manufactures silicon carbide chips, which are used in EVs.

Another Cause of Worry for Tesla Investors

Tesla investors were also concerned about the disclosure from Panasonic Holdings (PCRFF), a key battery supplier for Tesla. Panasonic announced a domestic production cut of 60% for the September quarter and lowered full Fiscal Year profit guidance by 15% due to reduced demand for higher-priced EVs.

This aligns with TSLA CEO Elon Musk‘s statements during the Q3 earnings call. He noted that higher interest rates might have an effect on customer demand for EV purchases.

Concluding Thoughts

The automakers’ margins are already struggling due to lower prices resulting from intense competition in the industry. To top that, weak EV demand is likely to further impact their margins.

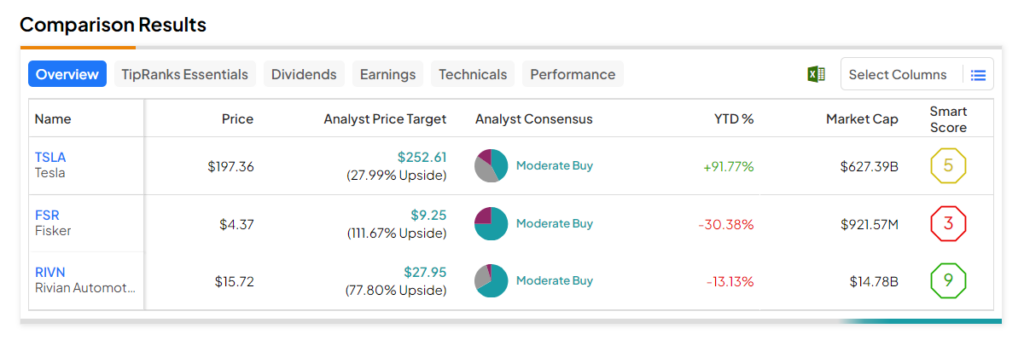

On TipRanks, all three stocks – FSR, TSLA, and RIVN – have a Moderate Buy consensus rating with plenty of upside potential expected by analysts. Among these stocks, RIVN’s Outperform Smart Score of nine indicates its potential to beat market averages.