Trulieve Cannabis (TRUL) more than doubled its revenue in its first quarter. The U.S. cannabis company dominates the Florida medical cannabis market.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Trulieve’s total revenue came in at $193.8 million for the quarter ended March 31, increasing 102% from $96.1 million in the prior-year quarter.

Meanwhile, net income amounted to $30.1 million in Q1 2021, compared to a net income of $23.6 million in Q1 2020. The multi-state cannabis operator achieved Adjusted EBITDA of $90.8 million, up 87% year-on-year.

On Monday, Trulieve announced it would acquire Harvest Health & Recreation Inc. This deal will create the largest U.S. cannabis operator.

Trulieve’s CEO Kim Rivers said, “During Q1 we continued to execute on growth in Florida as well as our national hub expansions. Our record revenue and industry-leading EBITDA margins demonstrate our continued focus on execution. The pending acquisition of Harvest will be transformative and will build on our profitability, expanding our runway for growth.” (See Trulieve Cannabis stock analysis on TipRanks)

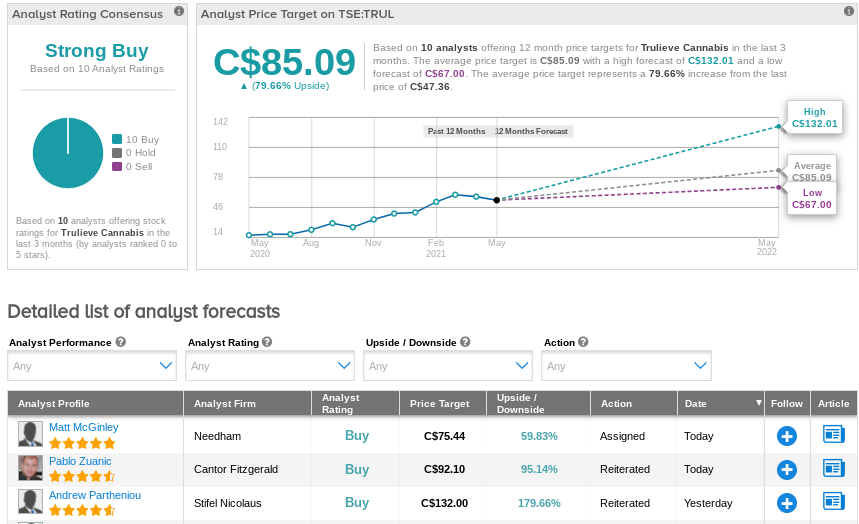

Today, Cantor Fitzgerald analyst Pablo Zuanic maintained a Buy rating on TRUL and a $76.00 price target (C$92.10) for 95% upside potential.

Zuanic explained in a note Thursday that Trulieve’s quarterly sales were lower than Cantor’s estimates but 3% higher than the FactSet consensus of $189.2 million. He said, “We stay Overweight, on valuation, growth potential, and the strength of the Florida franchise.”

Overall, consensus on the Street is that TRUL is a Strong Buy based on 10 Buys. The average analyst price target of C$85.09 implies 79.7% upside potential from current levels. Shares have risen nearly 200% in the last year.

Related News:

Rritual Superfoods Teams Up With Ultimate Sales Canada

Village Farms Swings To A 1Q Loss; Shares Plunge 20%

Trulieve To Acquire Harvest Health For C$2.1B; Creates Largest U.S. Cannabis Operator