Trinseo (TSE) has agreed to sell its synthetic rubber business to the US-based styrenics producer Synthos S.A. and its affiliates. Following the announcement, shares of the global materials company rose 3.9% to close at $66.01 on May 21.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Trinseo manufactures plastics, latex binders, and synthetic rubber. The deal is expected to close next year, subject to customary closing conditions and regulatory approvals.

The transaction is valued at approximately $491 million, which consists of $449.4 million in cash and pension liabilities worth $41.6 million. The net cash proceeds after transaction-related costs and taxes are expected to be approximately $400 million.

Additionally, on May 3, Trinseo completed the acquisition of Arkema’s polymethyl methacrylates (PMMA) business. The deal will enable Trinseo to offer enhanced solutions to its customers across several end markets. Moreover, the buyout is expected to generate approximately $50 million in annual synergies.

Trinseo CEO Frank Bozich said, “Following the acquisition of Arkema’s PMMA business, the divestiture of Synthetic Rubber provides Trinseo with a stronger balance sheet and greater flexibility to pursue organic and acquisition growth opportunities.”

Bozich added, “Synthos is well-positioned to leverage the numerous growth opportunities associated with Synthetic Rubber and its strategic commitment to the synthetic rubber industry makes it an ideal owner.” (See Trinseo stock analysis on TipRanks)

On May 6, Alembic Global analyst Hassan Ahmed maintained a Buy rating and a price target of $80 (21.2% upside potential).

Ahmed said, “Trinseo shares, on the back of strong positive earnings revisions, have risen almost three-fold since hitting their March 2020 lows. We believe consensus estimates continue to underestimate the company’s near- to medium-term earnings power. As such, we expect further positive earnings revisions and share price outperformance.”

Consensus among analysts is a Strong Buy based on 3 unanimous Buys. The average analyst price target stands at $80.33 and implies upside potential of 21.7% to current levels. Shares have gained 60.8% over the past six months.

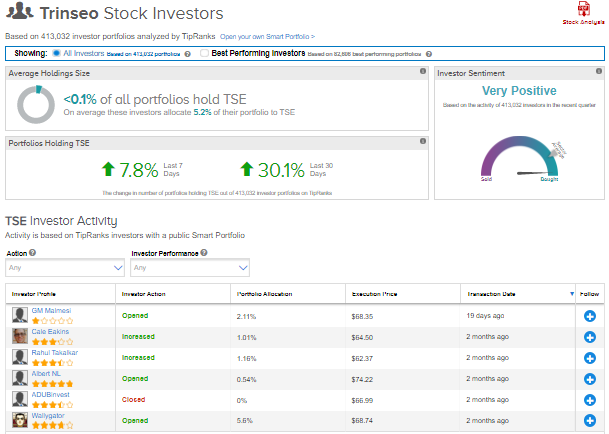

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Trinseo, with 30.1% of investors increasing their exposure to TSE stock over the past 30 days.

Related News :

Ashland Bumps up Quarterly Dividend By 9%

Home Depot to Buy Back $20B in Stock; Street Says Buy

Criteo Enhances Retail Media Business with Mabaya Buyout