Trian Fund Management has bought up 7.1 million in Comcast shares as the activist investor believes the cable operator’s stock is undervalued.

According to a SEC filing, the change in Comcast (CMCSA) holdings is as of June 30. Founded in 2005, Trian has $7.37 billion in assets under management and invests in undervalued and underperforming public companies, including Heinz, GE, P&G and Sysco, according to information on its website.

“Trian believes Comcast’s stock is undervalued. We have recently begun what we believe are constructive discussions with Comcast’s management team and look forward to continuing those discussions,” a Trian spokesperson told CNBC.

Trian owns about 20 million shares in Philadelphia-based Comcast, for a roughly $900 million stake or about 0.4% of the company, the Wall Street Journal reported. Comcast’s market value is about $204 billion.

Comcast’s NBCUniversal this week reached a deal with streaming player Roku to give it access to the Peacock app. In addition, Roku and NBCUniversal have renewed their agreement to keep 46 NBCU broadcast and cable apps on the Roku Channel.

Shares in Comcast have been on a steady gaining path since hitting a low in March and have gained 31% in the past 6 months. The stock has almost recouped all of its losses this year and is now trading 0.6% lower than at the start of 2020. (See CMCSA stock analysis on TipRanks).

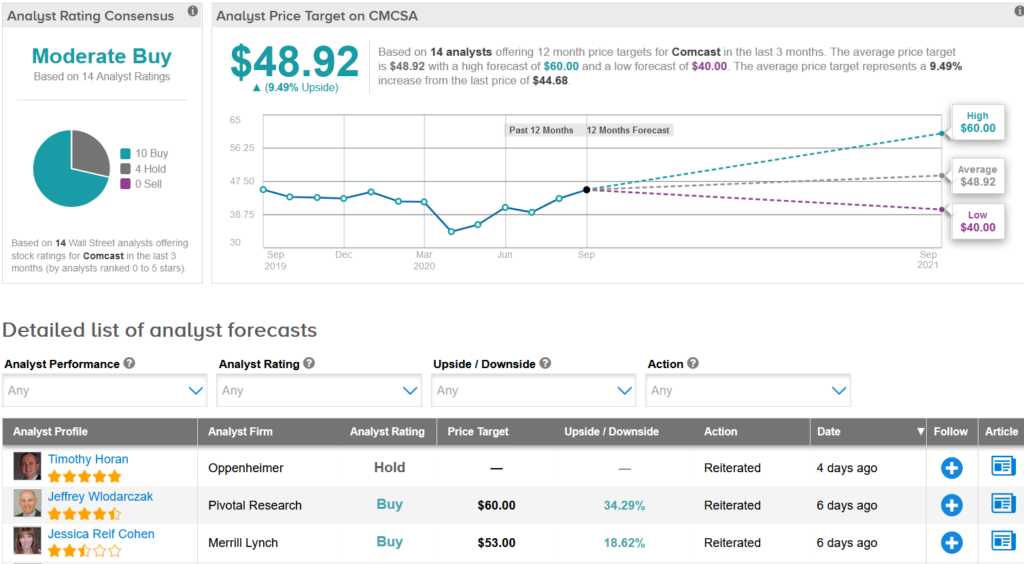

Pivotal Research analyst Jeffrey Wlodarczak last week raised the stock’s price target to a Street high of $60 (34% upside potential) from $52 and reiterated a Buy rating, following Comcast CEO Brian Roberts recent comments on the company’s record breaking Q3 net new data subscriber results of 500,000-plus.

Wlodarczak is also encouraged by Roberts’ statement that Q3 cable EBITDA growth is “well ahead” of the first half of 2020’s up 6%. Looking ahead, the analyst sees “healthy” cable EBITDA growth driven by strong high margin data subscriber gains.

The rest of the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 10 Buys and 4 Holds. Meanwhile, the average price target of $48.92 implies upside potential of 9.5% to current levels.

Related News:

Synchronoss Sinks 7% As CEO Out For ‘Personal Misconduct’; Analyst Sees 200% Upside

Microsoft To Buy Gaming Firm ZeniMax For $7.5 Billion

Illumina Confirms $8B Acquisition Of Cancer-Detection Firm Grail