Shares in Transocean Ltd (RIG), the world’s largest offshore drilling contractor, dropped 7.4% in Friday’s after-hours trading after an SEC filing revealed a potential major share sale.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

RIG shareholder Perestroika filed to offer 33,096,351 Transocean shares and 34,600,147 shares issuable upon exchange of $213,367,000 aggregate principal amount of 2.5% Senior Guaranteed Exchangeable Bonds due 2027 issued by Transocean.

The timing and amount of any sale is within the sole discretion of Perestroika, which means that ultimately the sale could not occur, or it could be for a reduced number of shares.

According to Bloomberg, RIG currently has 614,610,000 shares outstanding.

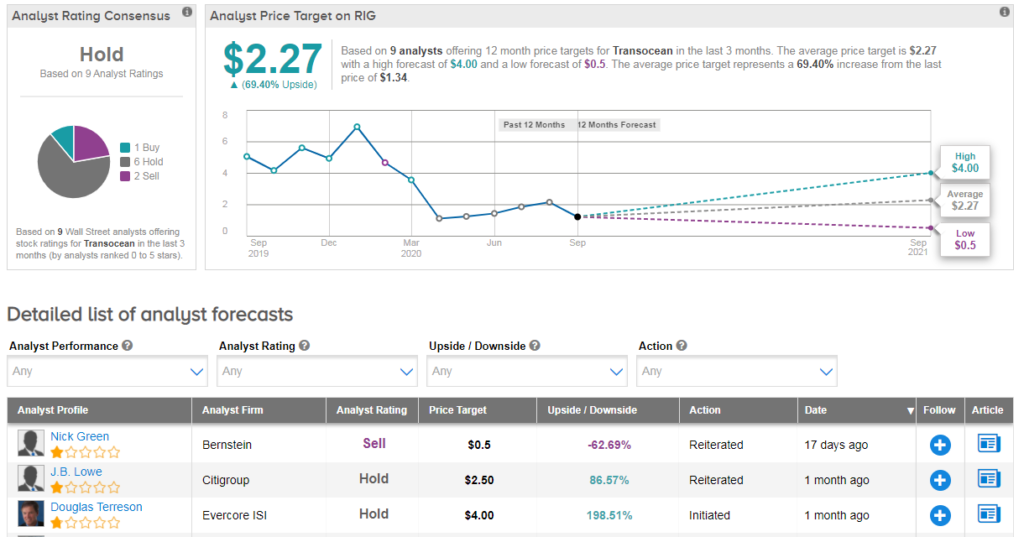

Shares in Transocean have plunged over 80% year-to-date, and the stock scores a cautious Hold consensus from the Street. Indeed, in the last three months, 6 analysts have published hold ratings, and 2 sell ratings, vs just 1 buy rating.

With share prices so low, the average analyst price target now indicates upside potential of almost 70%.

RBC Capital’s Kurt Hallead rates Transocean Underperform, Speculative Risk. “The fundamental outlook for the offshore drilling sector has radically changed with the COVID-19 economic impact and the collapse in oil price” he explained.

“Although the Chapter 11 risk for a number of offshore drillers remains high, we believe RIG can fight on without the need for a capital restructuring and has a chance to start generating FCF in 2022” the analyst added. He has a $2 price target on the stock. (See RIG stock analysis on TipRanks).

Related News:

Marathon Petroleum To Redeem $475M Senior Notes Due 2022

Abu Dhabi Oil Group Signs $5.5B Real Estate Deal With Apollo-Led Consortium

Buffett’s Berkshire Built Positions In Japan’s 5 Largest Trading Firms