In the business world, one of the main focal points is attaining first-to-market advantage. Nobody talks about the benefits of entering the market in second place. However, for legacy automotive giant Toyota (NYSE:TM), not being first may end up being a fortuitous move. With the EV sector suffering an implosion, the automaker looks wise, if not prescient. Thus, I am bullish on Toyota stock as it carefully approaches the EV market.

TM Stock Rises as EVs Attack Each Other

Toyota executives probably couldn’t imagine a better scenario playing out. While its major competitors have made a concerted push into electrification, Toyota has been slow to the transition. In fact, the company’s former CEO went so far as to state that a silent majority of automakers had doubts about pursuing an EV-only approach.

Now, the Japanese automaker’s lethargy is being handsomely rewarded. The legacy firms that once pushed for electrification in order to compete with Tesla (NASDAQ:TSLA) have now started scaling back or delaying their EV plans. Further, with demand suffering amid various headwinds, Tesla launched into a nasty price war last year. This drive to push prices down is hurting the entire industry, TSLA included.

It’s difficult to argue with the facts. As mentioned earlier, TM stock has gained 32% year-to-date. In sharp contrast, TSLA is down 33%. And frankly, Elon Musk’s company represents one of the better performers in the pure-play EV space.

Naturally, the price war is helpful for TM stock for two main reasons. First, the reason for any price war centers on a lack of demand. It’s an especially powerful dynamic when Tesla – the EV market leader – is the one initiating the bitter competition. If it was an upstart entity looking to make a name for itself, that’s understandable.

Tesla? The company shouldn’t need to resort to such tactics because it has tremendous social cachet. So, something must seriously be wrong with the broader EV market.

Second, the price war should theoretically help Tesla weed out the competition. However, it would also help Toyota. When the automaker is ready to embrace electrification, it will have less competition to deal with. In the meantime, the aggressively low pricing has wreaked havoc on Toyota’s mainline rivals, many of which jumped a bit too far into the deep end.

Toyota’s Path to Success: More Than Just an EV Implosion

To be clear, the bullish narrative for TM stock isn’t just about Toyota’s competitors knocking each other out. Undoubtedly, it’s helpful, and the company didn’t have to lift a finger for this chaos to materialize. However, Toyota is more than just a beneficiary of automotive Passover.

Instead, the company also forged its own path to upside. As TipRanks reporter Kailas Salunkhe mentioned late last year, TM stock has been on the rise thanks to a strong increase in global production. What’s particularly notable are Toyota’s gasoline-electric hybrid vehicles. Nearly a third of vehicle sales for the current fiscal year have stemmed from hybrids.

Earlier this year, The Wall Street Journal reported that this middle-ground category has been flying off dealer lots in the U.S., generating a windfall. Management went so far as to forecast a record $30.3 billion in net profit for the fiscal year ending March, thanks to rising sales of hybrids in all of its major markets.

This bonanza also represents a clear picture of contrasts with the EV industry. In December, Bloomberg reported that EV inventories hit a record high in the domestic market. Further, auto sales, in general, have slowed as American consumers suffer from sticker shock. However, Toyota is simply operating in a different paradigm, thus making TM stock quite attractive.

Even better, the market could continue shining on Toyota. According to government statistics, about 63% of all occupied housing units have a garage or carport. By logical deduction, that leaves 37% of housing units without such accommodations, meaning public charging is a must. However, that could become a serious inconvenience if EV adoption accelerates.

An arguably superior solution is to have a combustion-powered car that’s incredibly fuel-efficient. That’s where Toyota hybrids come in.

TM Stock’s Compelling Valuation

At the moment, TM stock trades at a trailing-12-month earnings multiple of 10.7x. That’s already deeply undervalued compared to the auto manufacturers’ average multiple of 18.9x.

However, the beautiful thing is that TM stock could be even more discounted than it appears on paper. Based on hybrid sales, Toyota is one of the few automakers performing well during this challenging time. In addition, the hybrid approach might not be a flash in the pan. Instead, it could be the mobility standard until EVs truly become convenient for everyone.

Is Toyota Stock a Buy, According to Analysts?

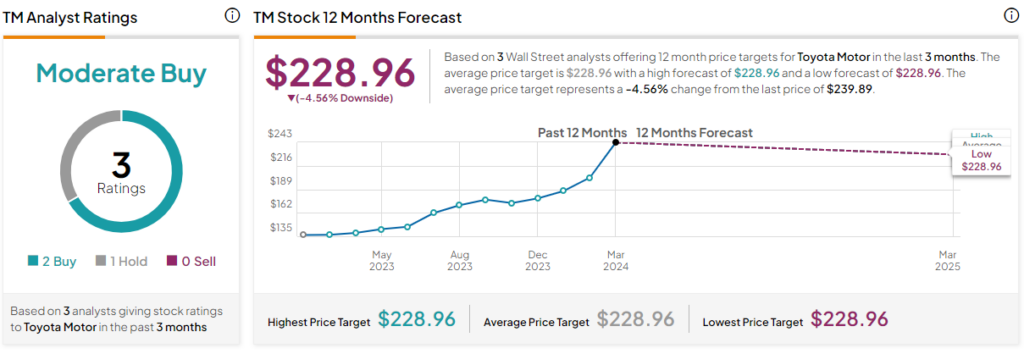

Turning to Wall Street, TM stock has a Moderate Buy consensus rating based on two Buys, one Hold, and zero Sell ratings. The average TM stock price target is $228.96, implying 4.6% downside risk.

The Takeaway: TM Stock Is an Automotive Hidden Gem

While Toyota has been very slow to adopt electrification, this lethargy appears to have turned out favorably for the company. With the EV sector facing serious demand challenges, Toyota’s mainline competitors have scaled back their EV ambitions. More importantly, hybrid sales have been through the roof, making TM stock an automotive hidden gem.