The Toronto Stock Exchange (TSE:XIU) is at an all-time high amid an ongoing boom in commodity prices.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Canada’s benchmark stock exchange finished trading on Sept. 26 at 24,033.83 points, its 26th record close of the year and the first time it has closed above 24,000 points. So far in 2024, the S&P/TSX Composite Index has risen 16%, driven higher by a rise in commodities, with prices for everything from gold to orange juice at or near record levels.

The latest record close for the Toronto Stock Exchange came on news that China’s government is taking steps to stimulate that country’s slumping economy, which is expected to increase demand for commodities in the nation of 1.4 billion people. Nearly half of the Toronto Stock Exchange’s weighting is comprised of stocks linked to commodities and mining.

How High Can the Toronto Stock Exchange Go?

The close above 24,000 points comes less than two months after the Toronto Stock Exchange surpassed 23,000 points for the first time. Analysts expect the Toronto bourse to continue trending higher this year as prices for metals, grains and other commodities, such as cocoa, continue climbing.

The Toronto index has also caught a tailwind in recent months from lower interest rates. The Bank of Canada began cutting interest rates in June of this year, moving ahead of the U.S. Federal Reserve. So far, Canada’s central bank has reduced rates by a cumulative 75-basis points and signaled that further cuts are likely in coming months as the domestic economy exhibits signs of a slowdown.

Is the iShares S&P/TSX 60 Index ETF a Buy?

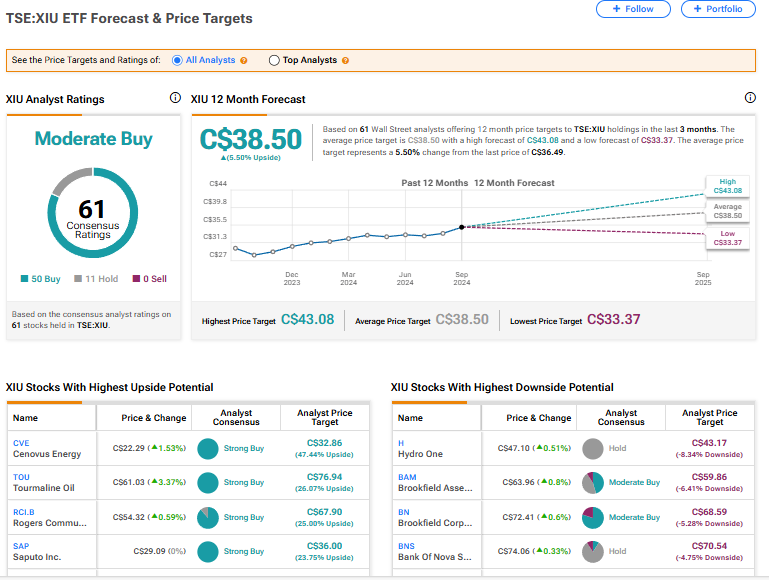

The iShares S&P/TSX 60 exchange-traded fund (ETF), which tracks the 60 largest securities on the Toronto Stock Exchange as measured by market capitalization, has a Moderate Buy rating among 61 Wall Street analysts. That rating is based on 50 Buy and 11 Hold recommendations made in the last three months. There are no Sell ratings on the ETF currently. The average price target of C$38.50 implies 5.50% upside potential from current levels.