Insiders are making major positive moves at TransDigm Group (TDG). Yesterday, TDG Director Robert Small lapped up TDG shares worth about $26.63 million in two transactions. Small purchased a total of 47,851 shares of the company.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

According to the Tipranks Insider Trading Tool, Small has been a major buyer of TDG shares with a success rate of 93% and an average profit of 41.2%. After these transactions, Small’s holding in TDG is now valued at about $1.5 billion.

Recent Developments

These transactions come on the heels of TDG’s recent second-quarter outperformance on its bottom-line front. In line with the consensus estimate, revenue grew 11.1% over the prior year to $1.33 billion. Earnings of $3.86 per share beat expectations by $0.17 per share on the back of a favorable sales mix, lower refinancing, and COVID-19 restructuring costs.

Additionally, earlier in March, TDG acquired DART Aerospace for a consideration of $360 million. DART is a leader in helicopter mission equipment and is expected to generate $100 million in revenue in 2022.

Analyst’s Take

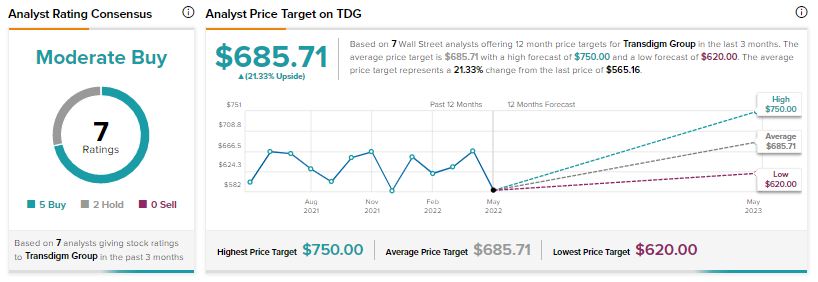

Jefferies analyst Sheila Kahyaoglu has reiterated a Buy rating on the stock but decreased the price target to $710 from $745.

Overall, the Street has a Moderate Buy consensus rating on TDG based on five Buys and two Holds. The average TDG price target of $685.71 implies a potential upside of 21.33%. That’s after a nearly 12% slide in the share price so far in 2022.

Closing Note

This major insider buying activity comes at a time when the broader markets are in turmoil, and should buoy investor sentiment toward the stock. Until now, TDG shares have outperformed the S&P 500 index, which is down about 17% so far in 2022. The recent quarterly performance, acquisitions, and insider activity may help maintain this momentum.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

GameStop Stock Reverses Gains Despite New Crypto Wallet

Meritor All Set to Expand Its Commercial Vehicle Portfolio

VMware Stock Climbing on Broadcom’s Takeover Talks