Monday’s market plunge, marked by NVIDIA’s (NVDA) staggering $465 billion single-day market cap loss, might just be a golden opportunity for investors, according to Tom Lee, head of Fundstrat Research. On CNBC, Lee called the sell-off an “overreaction,” saying, “Markets don’t like uncertainty, but this is a great opportunity for investors.” NVIDIA shares dropped 17% after China’s DeepSeek AI breakthrough rattled tech stocks, but pre-market trading has already shown signs of recovery, with the stock up 5%.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Bitcoin Bounces Back amid Uncertainty

Bitcoin wasn’t immune to the chaos, dipping to $97,500 before quickly recovering above $103,000. Lee highlighted Bitcoin’s resilience, noting its year-to-date outperformance compared to small caps and financials. This robust recovery, even after AI-driven fears, showcases the crypto market’s underlying strength.

Looking Ahead to the Fed Meeting

With the Federal Reserve’s policy meeting on Wednesday, the market is cautiously optimistic. The federal funds rate is expected to remain steady, but Lee warned that markets may be overly hawkish about a potential 2025 rate hike. For now, both Bitcoin and equities appear to be finding their footing after Monday’s dramatic sell-off.

Investors may find this moment an ideal entry point, as uncertainty often brings opportunities for those willing to seize them.

Are Nvidia Shares a Good Buy?

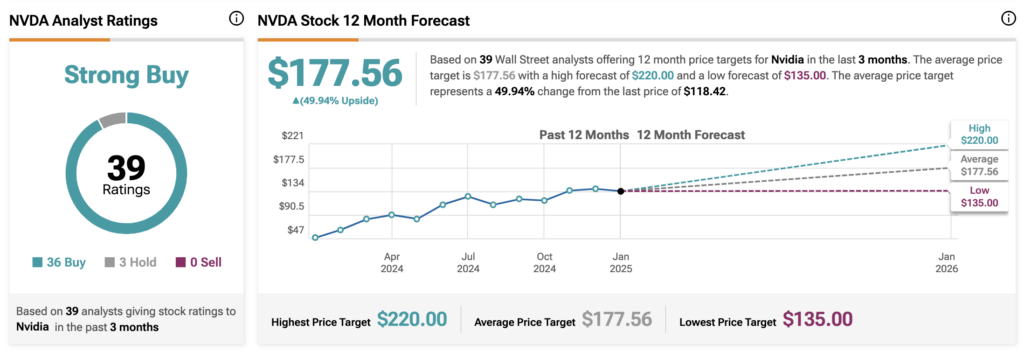

On TipRanks, NVDA stock holds a consensus Strong Buy rating from 39 Wall Street analysts, including 36 Buys and three Holds. The average Nvidia share price price target of $177.56 suggests a potential upside of 50% from its current price.