Tilray Brands (NASDAQ:TLRY) (TSX:TLRY) plunged in pre-market trading after the company issued weak guidance. In FY24, the cannabis company is guiding to adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) in the range of $60 million to $63 million. This is below the company’s prior forecast of adjusted EBITDA, which was between $68 million and $78 million.

In addition, Tilray does not expect to generate positive adjusted free cash flow for FY24, due to a delay in cash collection on sales of various assets. In the Fiscal third quarter, the company posted revenues of $188.3 million, up by 30% year-over-year but fell short of consensus estimates of $199.4 million.

Tilray’s Q3 net loss narrowed to $0.12 per share as compared to a loss of $1.90 per share in the same period last year. Analysts were expecting TLRY to report a loss of $0.05 per share.

What Is the Price Target for TLRY?

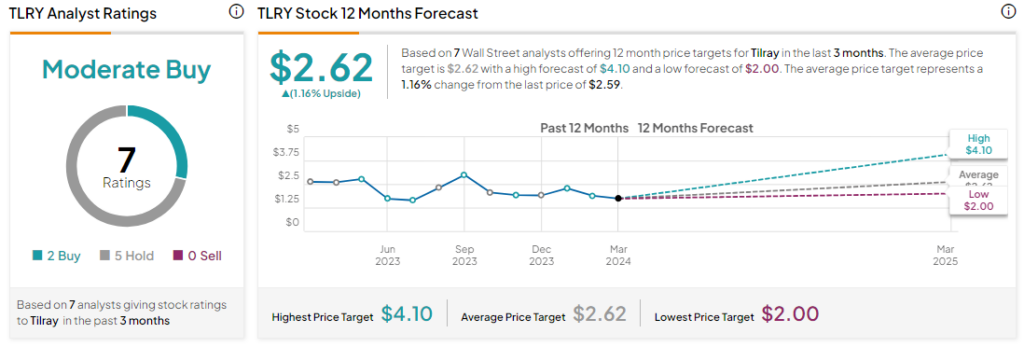

Analysts remain cautiously optimistic about TLRY stock, with a Moderate Buy consensus rating based on two Buys and five Holds. Year-to-date, TLRY has increased by more than 10%, and the average TLRY price target of $2.62 implies an upside potential of 1.2% at current levels. These ratings are likely to change as TLRY announced its Fiscal Q3 results today.