With the end of 2024 approaching, what could be more natural than to figure out the top stocks for the rest of the year?

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

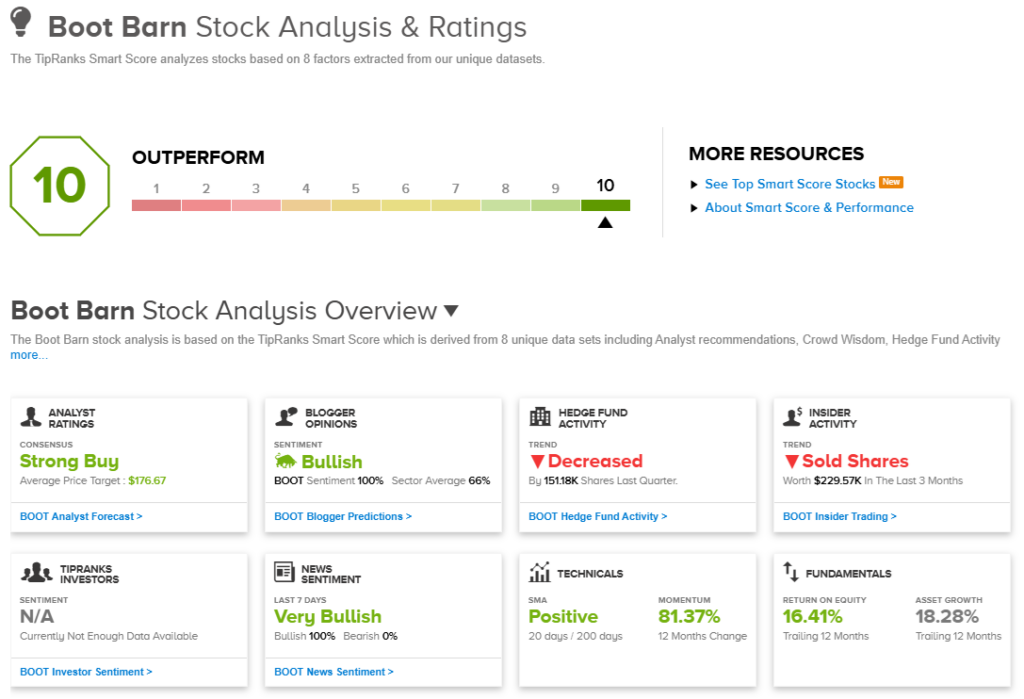

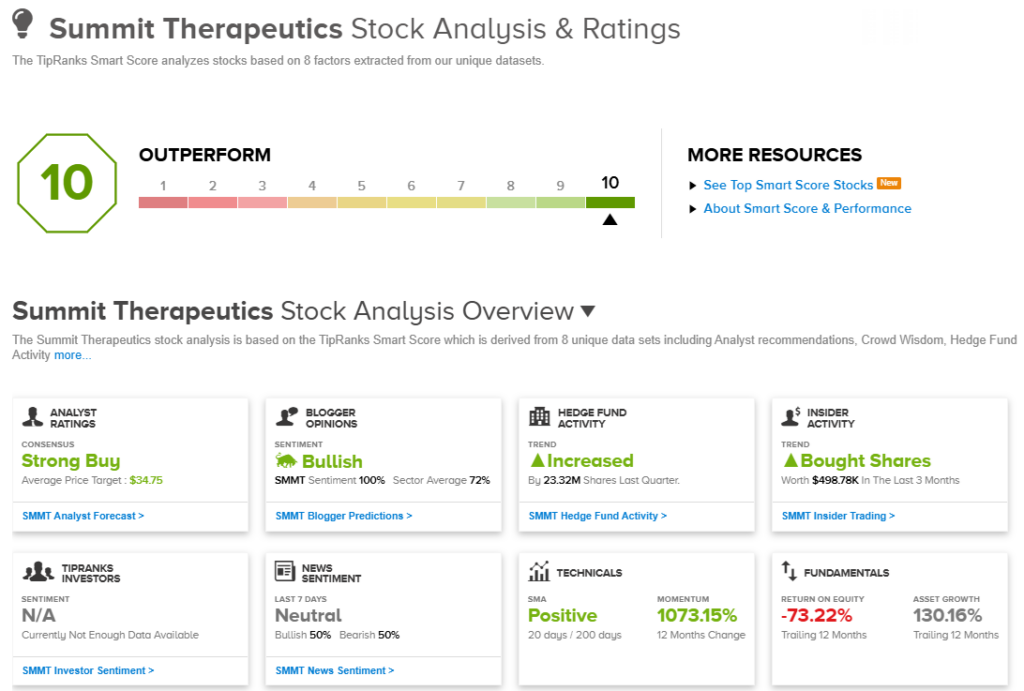

Stock picking of this sort is an essential skill for every investor, and fortunately, the Smart Score make it easier. This data gathering and sorting tool from TipRanks uses a combination of AI tech and natural language algorithms to gather and comb through the aggregated data of the stock market – data derived from thousands of traders dealing in thousands of stocks for tens of millions of daily transactions – and it uses that data to give every stock a simple score, on a scale of 1 to 10 and based on the stock’s standing against a set of factors known to match up with future outperformance.

We’ve opened up the TipRanks databanks to find two of these top-scoring stocks that investors should consider for the rest of 2024. These are ‘Perfect 10’ stocks, stocks that have earned the highest possible Smart Score.

Boot Barn Holdings (BOOT)

We’ll start in the retail world, with Boot Barn. This company operates in the lifestyle niche, offering customers a range of Western-themed apparel, footwear, and accessories. The company is particularly noted for its high-end Western boots and its cold-weather outdoor gear. Boot Barn also deals in hiking shoes and work boots, rugged work clothes, Western-style fashion, and even cowboy hats. The company’s clothing is marketed to men, women, and kids and is complemented by a range of décor and gifts.

The Boot Barn company was founded in 1978 and has grown since then to become the largest Western-themed lifestyle retail firm. The company operates through a network of brick-and-mortar stores, more than 420 of them across 46 states, and through an e-commerce operation that includes three websites: bootbarn.com, sheplers.com, and countryoutfitter.com.

BOOT shares have fallen 16% following the fiscal Q2 report on October 28. Revenue showed year-over-year growth, and earnings were in line with expectations, but investors reacted to the unexpected announcement that CEO Jim Conroy will step down on November 22.

Baird analyst Jonathan Komp sees the drop in share price as an opportunity and writes about the stock: “We were surprised by the stock’s sizable decline following the news CEO Jim Conroy plans to leave for Ross Stores in November, as strong continuity across BOOT’s remaining team reduces near-term disruption risk. Factoring BOOT’s +5% raise to F2025E EPS guidance, the >25% correction in BOOT’s NTM P/E appears overdone given strong comps momentum and near-term visibility. We also view pushback to BOOT’s ending inventory as flimsy, given limited markdown risk.”

Looking ahead, Komp quantifies the opportunity here, saying, “We remain confident in BOOT’s ability to deliver attractive relative earnings growth supported by compelling unit expansion opportunity. Valuation is back below the peer median, and we see a 12+ month bull-case approaching +50% upside with ~10-15% further downside justifying our move.”

These factors underpin Komp’s Outperform (i.e. Buy) rating on BOOT shares, with a price target of $167, suggesting a one-year upside potential of ~24%. (To watch Komp’s track record, click here)

Boot Barn has picked up 13 recent analyst reviews, and these break down to 10 Buys and 3 Holds to support the Strong Buy consensus rating. The shares are priced at $135.14 and have an average target price of $176.67, indicating potential for a ~31% gain in the months ahead. (See BOOT stock forecast)

Summit Therapeutics (SMMT)

Next on the list is Summit Therapeutics, a clinical-stage biopharma company that has brought a leading drug candidate, ivonescimab, into the late stages of the clinical testing process. The company has developed this candidate as a novel medicinal therapy with potential to treat a wide variety of cancers.

Ivonescimab is an advanced PD-1/VEGF bispecific antibody, a novel tetravalent molecule that combines two validated mechanisms in oncology and brings them to bear on the disease targets. To that end, Summit has multiple clinical trials ongoing for ivonescimab, in the US, China, and Australia. The most common disease target of these clinical trials is non-small-cell lung cancer, or NSCLC, the most common type of lung cancer. Across all of the clinical trials, to date, some 1,800 people have been treated with ivonescimab.

The most important recent news for Summit, and for ivonescimab, came in early September. At that time, the company announced that ivonescimab had beaten the results of Merck’s anti-cancer drug, Keytruda. Summit’s drug was tested in a Phase 3 trial, HARMONi-2, conducted in China, and showed that it could reduce the risk of disease progression or death by 49% when compared to the Merck drug. Summit’s shares jumped upward on the news, from $12.27 on Sept 6 to nearly $32 on September 13. While the shares have slipped back down since then, the stock remains elevated by almost 63% compared to the September 6 value.

Summit has several other catalysts coming up that have sparked analyst interest. The global Phase 3 HARMONi is expected to release topline data in the middle of next year, the global Phase 3 HARMONi-3 trial is scheduled for expansion, and the company expects to initiate the HARMONi-7 trial early in 2025.

This biotech firm caught the eye of JMP analyst Reni Benjamin, who likes the company’s strong clinical trial performance and its deep cash reserves.

“With lead asset Ivonescimab (Ivo) generating impressive data (doubling of PFS compared to pembrolizumab (pembro)) in a large randomized Phase 3 NSCLC trial in China, multiple Phase 3 U.S./Global NSCLC trials ongoing with one that has already completed enrollment, and a strong cash position of $487MM, we believe Summit shares represent a unique investment opportunity… We believe Summit has the potential to achieve commercialization in the smaller EGFRm and 1L NSCLC patient population, achieving $17.9B in global peak revenues upon the potential commercialization into 1L NSCLC by 2034,” Benjamin opined.

To this end, the analyst rates SMMT shares an Outperform (i.e. Buy), while his $32 price target implies a 50% gain for the next 12 months. (To watch Benjamin’s track record, click here)

Overall, there are 4 recent analyst reviews on record for this stock, with a 3-to-1 split favoring Buy over Hold, contributing to a Strong Buy consensus rating. With the stock currently trading at $21.41 and an average target price of $34.75, there’s an upside potential of 62% for the year ahead. (See SMMT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.