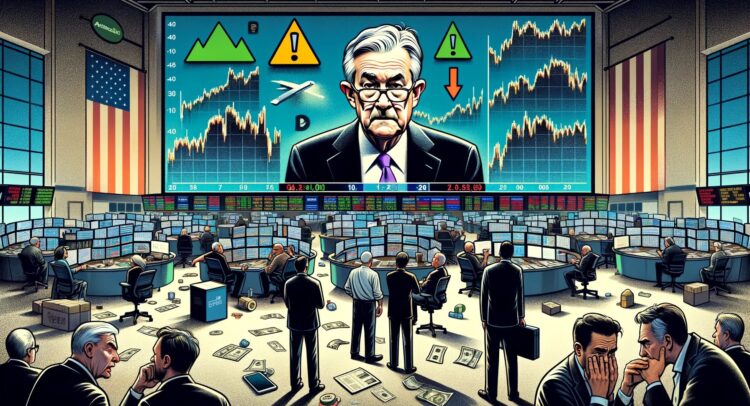

Stocks logged their worst day since September on Wednesday, after Federal Reserve Chairman Jerome Powell shattered investors’ hopes for an imminent rate cut.

Stocks were also under pressure as Alphabet (GOOGL) and Microsoft (MSFT) dropped. While both “Magnificent Seven” companies produced solid overall Q4 results, investors were disappointed by Google’s weaker-than-expected ad revenues and MSFT’s in-line projection for this quarter’s revenue outlook. Advanced Micro Devices (AMD) also weighed on stocks, as it fell after delivering weak Q1 2024 guidance. In addition, some worries about regional banks resurfaced after New York Community Bancorp (NYCB) surprised investors with a dividend cut.

The Fed held its interest rate steady for a fourth straight meeting, which was widely expected, but the comments accompanying its policy decision delivered a blow to sentiment. While policymakers removed a sentence from their statement that mentioned a possible “additional policy firming,” they added a line signaling no rate cuts until they are certain that “inflation is moving sustainably toward 2%.”

Powell’s remarks after the FOMC meeting dealt another blow to rate-cut expectations, as he said he doesn’t expect that the central bank “will reach a level of confidence by the time of the March meeting” needed to reduce policy rates. However, the Fed Chairman emphasized that future rate decisions will continue to depend on incoming data. One of the most policy-impacting data points, the labor market report, is coming out on Friday.