Private-equity firm Thoma Bravo has entered into a deal to acquire property management software provider RealPage for $9.6 billion as part of a leveraged buyout deal, The Wall Street Journal has learnt.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The purchase price of $88.75 per share represents a premium of 31% to RealPage’s (RP) closing price on Dec. 18.

“We were able to do quite well during the pandemic because there was a rush by our industry to go virtual, and we were one of the platforms that did that,” RealPage CEO Steve Winn told the WSJ.

RP shares have gained 26% year-to-date and are trading at a 3% discount to their 52-week high. (See RP stock analysis on TipRanks)

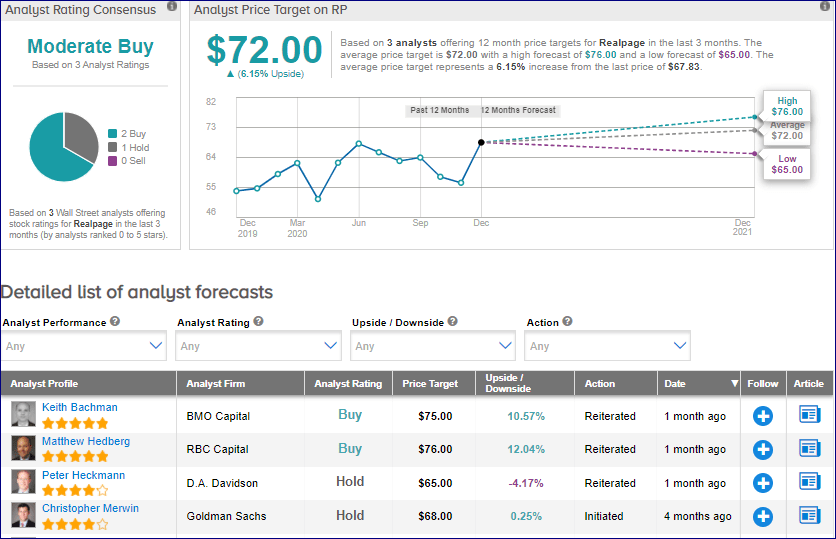

DA Davidson analyst Peter Heckmann a month ago reiterated a Hold rating on the stock and lowered the price target from $70 to $65 ahead of its Q3 results.

Heckmann warned that the company’s margins are facing “conflicting forces” in the quarter while pointing to its management having discussed the potential risks in the current environment from high unemployment and a pandemic-pressured economy as part of its Q2 results in July.

From the rest of the Street, the stock scores a cautiously optimistic analyst consensus of a Moderate Buy based on 2 Buys and 1 Sell. The average analyst price target of $72 implies upside potential of 6.2% to current levels.

Related News:

Boeing Wins Fourth Contract With Singapore Air Force; Shares Down 33% YTD

Wells Fargo To Resume Share Buyback, Dividend Plans In 1Q; Shares Rise 3%

FedEx Distributes Moderna’s Covid-19 Vaccine; Street Sees 21% Upside