First published: 3:42AM EST

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Private equity firm Thoma Bravo has snapped up Coupa Software (NASDAQ:COUP) after outbidding another private equity firm, Vista Equity for $8 billion. After this deal, Coupa will be privately held.

Coupa, a cloud-based business spending platform, offers customers advanced spend visibility, supply chain risk reduction, and increased business agility.

This acquisition also includes a “significant minority investment from a wholly owned subsidiary of the Abu Dhabi Investment Authority (ADIA).”

As a part of this deal, Coupa shareholders will receive $81 per share in cash, indicating a 77% premium to Coupa’s closing stock price on November 22. “The transaction consideration also represents a premium of approximately 64% to the volume weighted average closing price of Coupa stock for the 30 trading days ending on November 22, 2022.”

Ever since its inception, Coupa Software has been incurring operating losses and does not expect to turn profitable soon due to ongoing investments in research & development and sales & marketing. Moreover, frequent acquisitions have affected its balance sheet with rising levels of goodwill and intangible assets.

Given that Thoma Bravo has made several tech acquisitions in the past and has managed to stabilize the businesses under its umbrella, the acquisition of Coupa could bode well for the business.

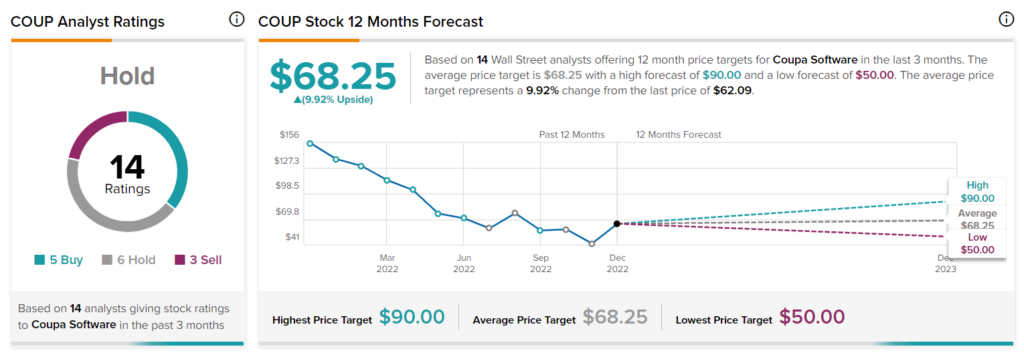

Wall Street suggests waiting on the sidelines on COUP stock with a Hold consensus rating based on five Buys, six Holds, and three Sells. The average price target of $68.25 indicates an upside of 9.92% over the next year.