Thor Industries (NYSE:THO) shares plunged by nearly 15% in the opening session today after the recreational vehicles provider posted its results for the second quarter. Revenue declined by 6% year-over-year to $2.21 billion, missing expectations by $60 million. EPS of $0.13 lagged estimates by a wide margin of $0.54. Additionally, the company lowered its financial outlook.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

THO is witnessing pressure on its top line due to difficult macroeconomic conditions. Its Q2 performance was marked by seasonally lower demand and cautious sentiment at its dealers. During the quarter, net sales in the North American Towable RV segment declined by 11.9% to $731 million. Similarly, net sales in Thor’s North American Motorized RV segment contracted by 22.8% to $570.4 million. In contrast, net sales in its European RV segment improved by 20.9% to $782.3 million on the back of higher volumes and pricing.

While the business environment remains challenging, Thor anticipates an improvement in market conditions as 2024 progresses. However, the company has lowered its financial outlook for Fiscal Year 2024. It now anticipates net sales in the range of $10 billion to $10.5 billion versus the prior estimate of between $10.5 billion and $11 billion. EPS for the year is seen landing between $5 and $5.50. Earlier, Thor estimated the figure in the range of $6.25 to $7.25.

Is Thor Industries Stock a Good Buy?

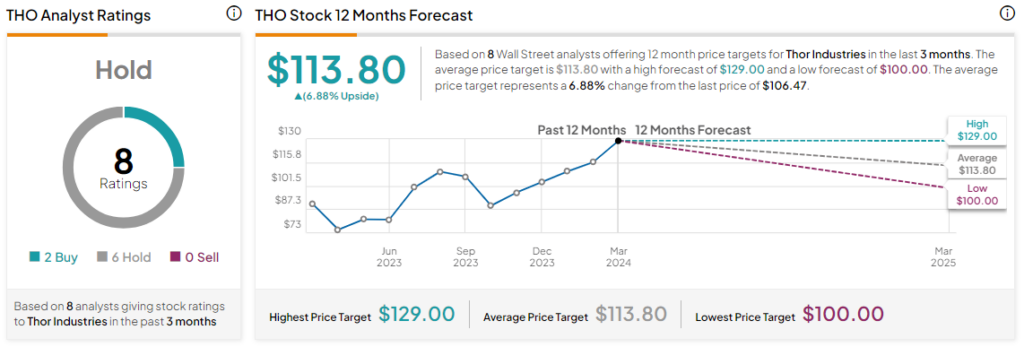

Despite today’s price erosion, shares of the company are still up by nearly 36% over the past year. Overall, the Street has a Hold consensus rating on Thor Industries alongside an average price target of $113.80. However, analysts’ views on the stock could see a revision following today’s earnings report.

Read full Disclosure