The lithium industry continues to face one of its worst slumps, with the price of lithium carbonate currently hovering at its lowest in the past four months. Lithium producers, though, seem to be oscillating between prudence and pinning their hopes on a future rebound.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Are New Plant Investments Justified?

A major development from the Fastmarkets Lithium Supply and Battery Raw Material Conference in Las Vegas this week is a comment from a top Albemarle (NYSE:ALB) executive. Eric Norris, the President of Energy Storage at ALB, noted that lithium’s current low prices do not justify new plant investments for the metal. Albemarle is the largest lithium producer for EV batteries globally. The company’s share price, however, is down by nearly 57% over the past year.

An Oil Giant’s Lithium Bet

At the other end of the spectrum is oil major Exxon Mobil (NYSE:XOM). The company is betting on lithium, expecting its lithium operations to coexist alongside its oil business. Speaking at the Fastmarkets Conference, Patrick Howarth, Exxon’s global business manager for lithium, noted that the world needs substantially more lithium than it is producing today. Exxon plans to bring its first lithium project online in 2027. According to Bloomberg, the company aims to produce enough lithium for a million EVs annually by the end of this decade. This week, Exxon signed an agreement to supply lithium from its Arkansas operations to South Korean battery developer SK On.

Potential Headwinds for Lithium

Despite the long-term optimism for growing demand, broader technological factors could impact the lithium industry. The development of advanced batteries that need less lithium or use different battery materials could impact the sector. Additionally, more efficient battery recycling technologies could result in lower demand for lithium producers.

How Much Is LIT?

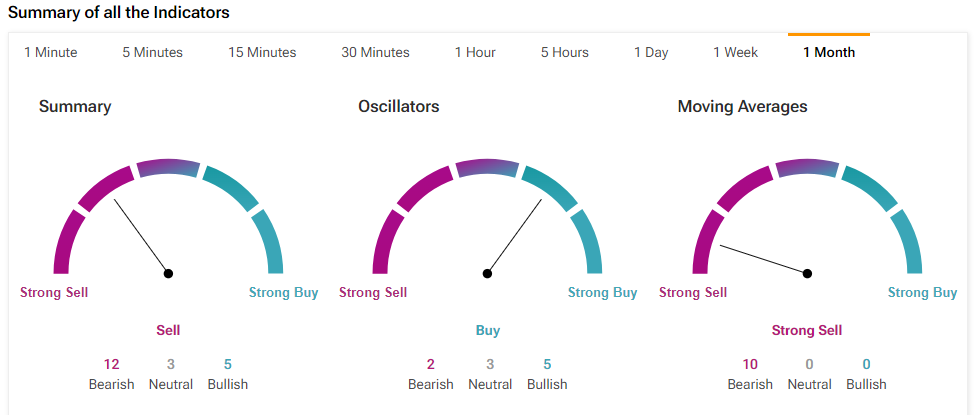

Meanwhile, the Global Lithium & Battery Tech ETF (LIT) at $39.22 is now hovering at its lowest level in nearly three years. The TipRanks Technical Analysis tool is also flashing a Sell signal on the ETF on a monthly timeframe, indicating continued bearish pressure.

Ready to “commodi-tize” your knowledge? Click here to dive into the world of commodities on TipRanks

Read full Disclosure