Lithium carbonate prices have tanked by nearly 10% over the past month and around 69% over the past year. The major slump is due to persistent price weakness, a slowdown in EV sales, and a major production ramp-up in the lithium market. Meanwhile, new EU tariffs on Chinese EVs, a major rare earth metal discovery in Norway, and Trump’s stance on U.S. EV policy are the top developments for the lithium industry this week.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

EU Imposes Tariffs on Chinese EVs

The EU is slapping tariffs of up to 38% on Chinese EV imports, likely beginning next month. The European Commission noted that the EV industry in China benefits from unfair subsidization, which threatens Europe’s EV producers. Still, shares of top Chinese EV maker BYD (OTC:BYDDF) (HK:1211) rallied this week after the company was imposed with lower-than-expected tariffs. Meanwhile, China has urged the EU to reverse its tariffs.

A Mega Discovery in Norway

A key cause of concern in the West is China’s grip on crucial rare earth metals, seen as a backbone of the world’s drive towards a green future. According to CNBC, China accounts for nearly 70% of the world’s rare earth ore extraction and 90% of its processing.

In contrast, Europe has no extraction of rare earth metals at present. However, this scenario may change after mining company Rare Earths Norway discovered Europe’s largest proven deposit of rare earth metals in Norway. This discovery of rare earth oxides totaling around 8.8 million metric tons could boost Europe’s EV ambitions.

Trump on EVs

In another major development, former U.S. President Donald Trump noted that he would reverse the current U.S. EV policy if elected President later this year. The current U.S. administration has been pushing for a wider adoption of EVs. A less welcoming U.S. stance for EVs could further dent the lithium industry in the future.

Is LIT a Good Investment?

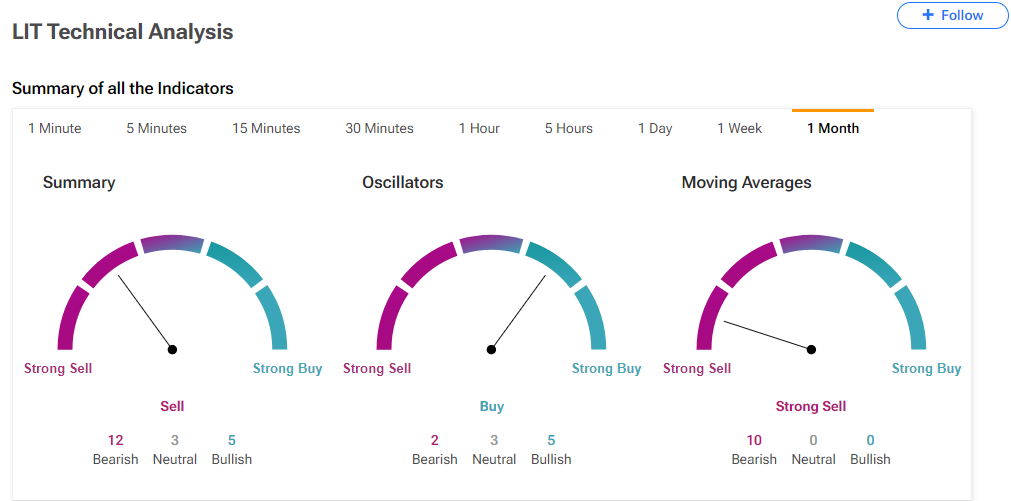

In the meantime, the Global Lithium & Battery Tech ETF (LIT) at $41.29 per share is down by nearly 14% over the past six months. The TipRanks Technical Analysis tool is flashing a Sell signal on the ETF on a monthly timeframe, indicating continued Bearish pressure.

Ready to “commodi-tize” your knowledge? Click here to dive into the world of commodities on TipRanks

Read full Disclosure

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue