One of the biggest developments in the lithium sector this week was a sharp correction in Albemarle (NYSE:ALB) stock. Meanwhile, a promising new lithium extraction method could shake up the industry in the coming years.

Albemarle’s Plunge

Shares of Albemarle, the largest lithium producer globally, plunged to new lows for the year after Robert W. Baird’s Ben Kallo lowered his price target on the stock to $127 from $170. Kallo expects the current scenario of rock-bottom lithium prices to impact ALB’s Q2 performance.

The Promise of DLE

Meanwhile, a promising new extraction method for lithium could lead to upheaval in the lithium sector over the coming years. This week, International Battery Metals (TSE:IBAT) became the first company to commercially produce lithium using a version of the method called direct lithium extraction (DLE). Traditionally, lithium has been produced via evaporation methods, where lithium-containing brine is left exposed to sunlight in large pools. DLE, on the other hand, extracts lithium at a much faster rate and is more environmentally friendly.

With around 70% of global lithium found in brines, this technology could substantially transform the industry in the coming years. Importantly, its wider adoption could help lithium producers reduce costs and improve margins. IBAT’s site in the U.S. is expected to produce nearly 5,000 metric tons per year, and similar efforts are underway in other locations. According to Reuters, French miner Eramet (FR:ERA) is exploring DLE to commercially produce lithium in Argentina, aiming to produce 24,000 metric tons of lithium carbonate annually from the plant by the middle of next year.

How Much Is LIT?

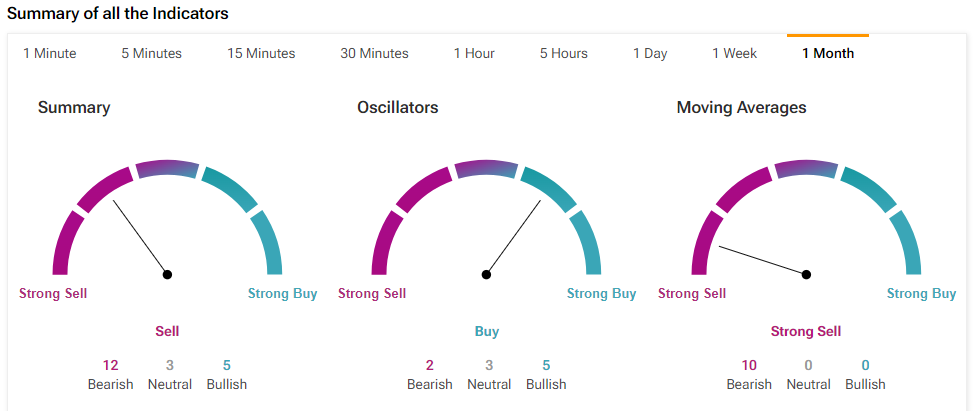

Meanwhile, the Global Lithium & Battery Tech ETF (LIT) continues to mine new lows. At $40.86, LIT is now hovering at its lowest since November 2021. The TipRanks Technical Analysis tool is flashing a Sell signal for LIT on a monthly timeframe, indicating continued selling pressure.

Ready to “commodi-tize” your knowledge? Click here to dive into the world of commodities on TipRanks

Read full Disclosure