Energy is the foundation for life, and it could also become a significant growth driver for Tesla (NASDAQ:TSLA) in the years ahead.

In Q2, Tesla’s energy division stood out, showing robust growth and acting as a bright spot, while its main auto segment continues to struggle.

Now, according to William Blair’s Jed Dorsheimer, one of the top 3% of analysts on Wall Street, it’s time to shift greater attention toward this promising division.

In fact, Dorsheimer thinks Tesla Energy is the “most underappreciated component of the Tesla story.” Given the slowdown seen in the EV part of the business, the 5-star analyst thinks that over the near-term the “narrative will shift toward the energy storage business.”

Dorsheimer sees plenty of growth in store, reckoning Tesla Energy will grow at a 50% compound annual rate, with its overall revenue contribution rising from 6% to 25%, and accounting for $3.35 in EPS by 2028.

The analyst’s confidence is based on analysis that shows demand for Tesla’s Megapack – its utility-scale energy storage product – is primarily driven by grid stabilization needs, the expansion of data centers, and the integration of renewable energy sources, and that the “size of the opportunity far exceeds Tesla’s production capacity.” It also has by far the best product on the market, with Dorsheimer viewing the Megapack as the “standalone leader in energy storage.”

Additionally, Tesla also manufactures the Powerwall, a compact energy storage system intended for residential, as well as small commercial and industrial use. The Powerwall is designed to be paired with solar power systems, offering dispatchable backup power and Dorsheimer sees it as another “industry-leading” offering.

Looking at the bigger picture for Tesla, the energy endeavors are another facet of a multipronged approach, and one that brings to mind another tech giant with its fingers in many pies.

“Combined with the auto business and longer-term opportunities like AI, robotaxi, and robotics, we see Tesla as a technology leader with an ‘Apple-esque’ ecosystem for the future of energy,” Dorsheimer summed up.

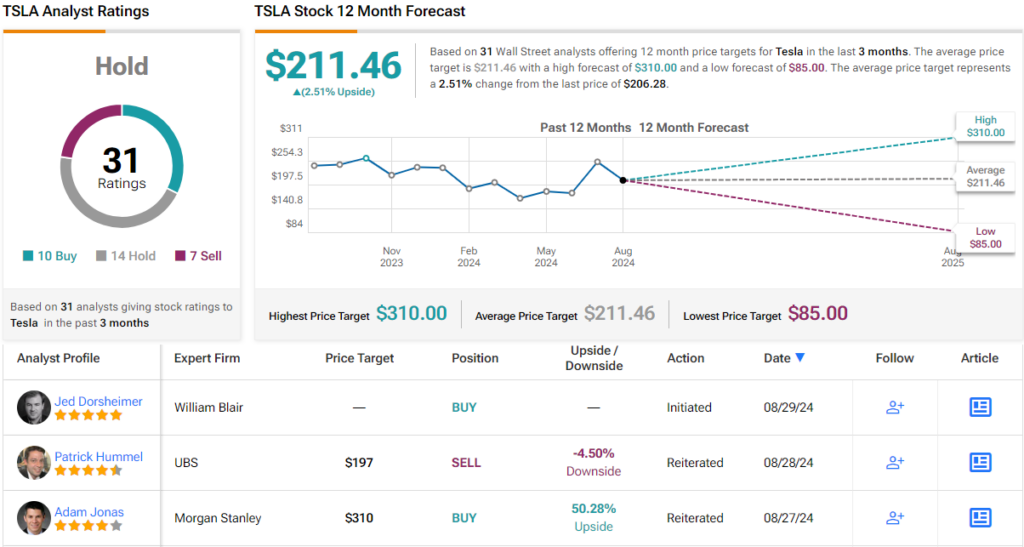

Bottom line, Dorsheimer initiated coverage of Tesla with an Outperform (i.e., Buy) rating although he has no specific price target in mind. (To watch Dorsheimer’s track record, click here)

The rest of the Street does have an idea of where Tesla’s share price is heading, and the conclusion is that it is going nowhere right now. The average target currently stands at $211.46, indicating the shares are fully valued. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.