Tesla (NASDAQ:TSLA) shares have certainly been soaring over the past few weeks, fueled by post-election excitement surrounding Elon Musk’s role and influence in a second Trump Administration.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Musk, the serial entrepreneur and would-be colonizer of Mars, has been making headlines recently, with his high-profile support of president-elect Donald Trump catapulting him further into the public eye.

However, one top investor, known by the pseudonym Stone Fox Capital, does not believe that the current upswing has staying power.

“Investors are now buying into a lot of hype following the elections, some of which isn’t necessarily bullish for the stock,” asserts the 5-star investor, who sits in the top 4% of TipRanks’ stock pros.

For starters, Trump has signaled his intention to eliminate the $7,500 EV credit for consumers. Though the majority of TSLA sales come from abroad, Stone Fox predicts this would still deliver a financial setback for the company.

“The loss of the EV credit would appear to hurt Tesla, as much as competitors in the robotaxi race as competitors like Rivian,” Stone Fox explains. The investor also highlights Musk’s own admission that Tesla’s robotaxi initiatives are partly reliant on this tax incentive.

As it is, Tesla’s future plans hinge heavily on favorable regulatory policies, particularly in the self-driving space. Unlike Google’s Waymo, which has secured local deals in four cities, Tesla does not have an approved robotaxi service, reminds Stone Fox, making federal rules even more crucial for the company.

“Tesla definitely benefits the most from having federal regulations, which would potentially allow the current 7 million customers to become robotaxis at the update of FSD [full self-driving] software,” adds the investor.

However, Stone Fox urges investors to remember that Congress moves at a snail’s pace, with federal legislation likely taking years to become law.

“Investors should allow the recent hype to disappear, where Tesla will fall to more attractive levels, to speculate on the robotaxi future at more attractive risk/reward levels,” Stone Fox summed up. Accordingly, the investor rates TSLA shares a Sell. (To watch Stone Fox Capital’s track record, click here)

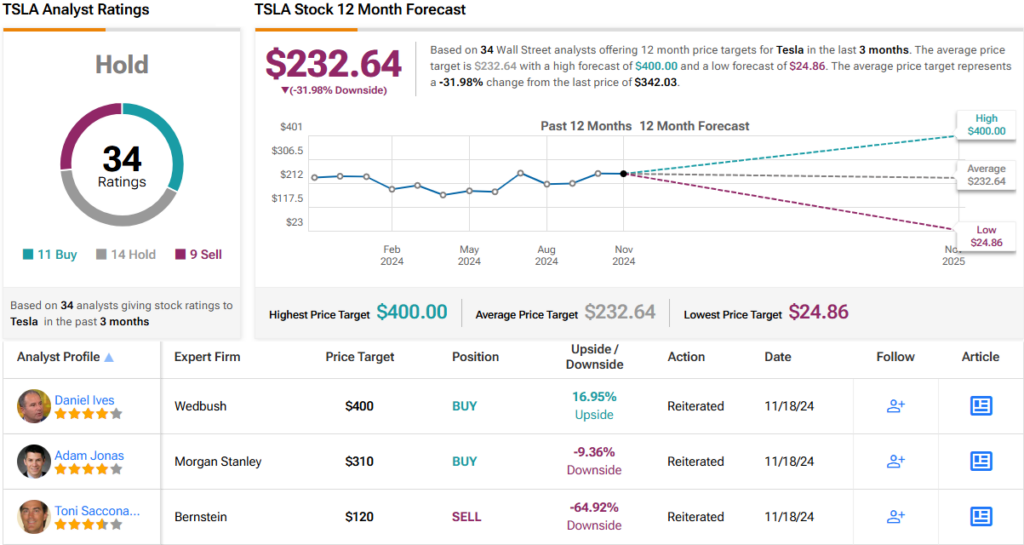

Wall Street analysts are not so bullish on TSLA either. With 11 Buy, 14 Hold, and 9 Sell ratings, TSLA claims a Hold (i.e. Neutral) consensus rating. Its 12-month average price target of $232.64 implies ~32% downside from current levels. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.