A stockholder with a position of more than 10% in Avaya Holdings Corp. (NYSE:AVYA), Theodore Walker Cheng-de King, has bought the company’s shares worth $5.25 million. According to an SEC filing, the shareholder bought 1,930,600 Avaya shares in the range of $2-$3 per share. Following his transaction, Theodore now holds about 13,231,350 shares of Avaya.

Meanwhile, the transaction spiked investors’ interest in the stock as it rose around 26.7% to $0.8011 from $0.6320 on August 17. Despite the surge, the total value of Theodore’s aforementioned Avaya holdings is down more than 50%, based on his purchase price that was in the range of $2-$3.

According to TipRanks, which also provides a comprehensive list of daily insider transactions, various corporate insiders have bought and sold AVYA stock in the last three months. TipRanks’ Insider Trading Activity tool shows that corporate insiders have brought AVYA shares worth $7.2 million in the last three months.

Interestingly, TipRanks also provides a list of hot stocks that boasts of either a Very Positive or Positive insider confidence signal.

Is Avaya a Good Stock to Buy?

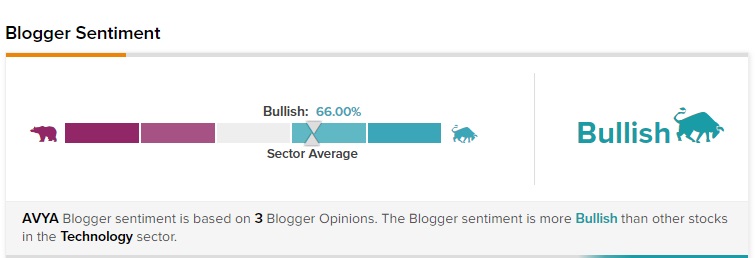

While analysts are neutral, retail investors and financial bloggers look bullish on AVYA stock.

According to TipRanks, the Street has a Hold consensus rating on the stock, which is based on one Buy, three Holds, and one Sell.

However, TipRanks data shows that financial bloggers are 66% Bullish on AVYA, in line with the sector average. Further, retail investors have increased their portfolio holdings in AVYA by 28.1% in the last 30 days.

Key Takeaways for AVYA Investors

As of now, corporate insiders are seen taking advantage of the company’s weak stock price, which has fallen 96.1% so far this year. The recent insider activities also signal that this could be the right time to gain exposure to the stock, given that AVYA’s average price forecast of $2.48 implies 209.6% upside potential to current levels.

Read full Disclosure.