Shares of the THG Group PLC (GB:THG) declined over 10% as of writing after the company announced a potential demerger of its technology platform, THG Ingenuity. With this move, the company aims to strengthen its balance sheet by leveraging its cash-generating Nutrition and Beauty businesses. Additionally, the company released its first-half results for 2024.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

THG Group is a UK-based e-commerce company that sells own-brand and third-party cosmetics, dietary supplements, and luxury goods.

THG’s Demerger on the Cards

If the demerger of THG Ingenuity proceeds, the company will focus on THG Beauty and THG Nutrition. Both of these businesses are highly profitable, generate strong cash flow, and have the potential to pay dividends. Meanwhile, THG Ingenuity offers online commerce services to other retailers and has been incurring annual cash losses.

THG Group also plans to seek a listing for its core Beauty and Nutrition divisions to improve its declining share price. The company further stated that the new listing structure would enhance its chances of being included in the U.K. stock indexes and improve liquidity for its shares.

THG Reveals Interim Results for 2024

THG Group reported a 2.2% year-over-year increase in revenues in H1 on constant currency, reaching £911.1 million. Adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) grew 3.6% year-over-year to £48.8 million.

Within its segments, THG Beauty’s sales increased 5.7% to £531 million, while the Ingenuity business saw a 12.6% rise in its sales, reaching £80.2 million. On the other hand, THG Nutrition’s sales declined 10.9% to about £300 million.

What Is the Price Prediction for THG?

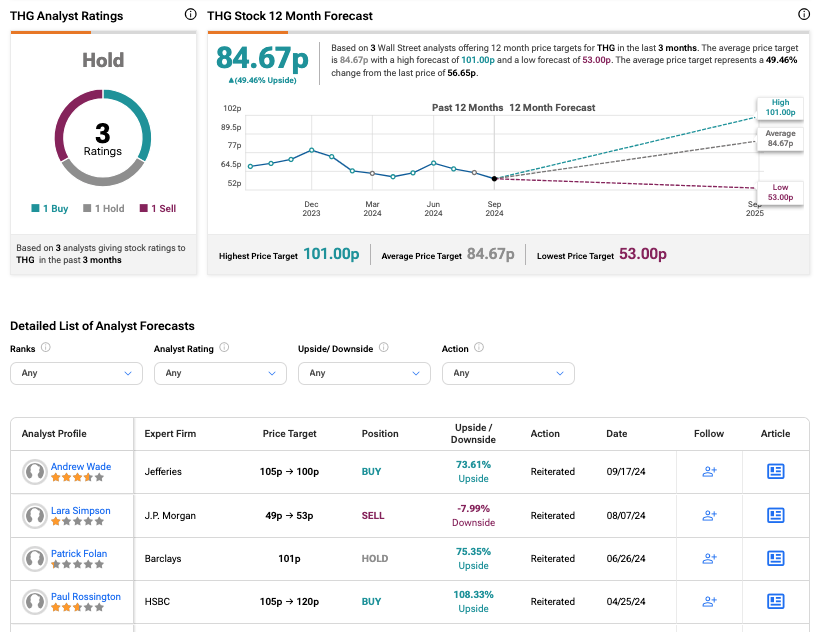

Jefferies analyst Andrew Wade praised the potential demerger and suggested it could create value for shareholders. Today, Wade confirmed a Buy rating on the stock while reducing his price target from 105p to 100p. This implies an upside of 74% in the share price.

As per the consensus among analysts on TipRanks, THG stock has been assigned a Hold rating based on three recommendations from analysts. The THG share price target is 84.67p, which is 50% above the current level.