Bank of America (BAC) has reiterated Buy ratings for three aerospace stocks. Analyst Ronald Epstein recently increased his price targets for both GE Aerospace (GE) and Lockheed Martin (LMT), maintaining Buy ratings for both, as well as for aerospace peer RTX Corporation (RTX), predicting significant upside potential for all three.

Wall Street’s bullish sentiment toward these standout aerospace stocks has been rising lately. All three have experienced significant growth over the past year, and experts believe this trend will continue. Let’s take a closer look at the aerospace stocks Epstein sees as likely 2025 winners.

What’s Happening with Aerospace Stocks?

Of the three aerospace stocks that Epstein recently commented on, only GE Aerospace is performing well today. As of this writing, it is up 4% for the day, outperforming RTX, which has gained less than 1%. Lockheed Martin is in the red today despite an impressive Q3 earnings report. However, over the past three months, RTX has been the strongest performer, rising 21%.

Despite this volatility, Wall Street’s overall outlook on all three aerospace stocks is bullish. Epstein increased his GE stock price target from $180 to $200 and his LMT price target from $635 to $685. These predictions imply upside potential for these stocks of 10% and 19%, respectively. His RTX price target of $145 implies a 15% upside potential.

TipRanks reporter Christine Brown provided context on Epstein’s RTX take, stating, “With a substantial backlog and significant international bookings, RTX is well-positioned to benefit from increasing defense demand, particularly from international customers.”

Which of these Aerospace Stocks Are the Strongest Buys?

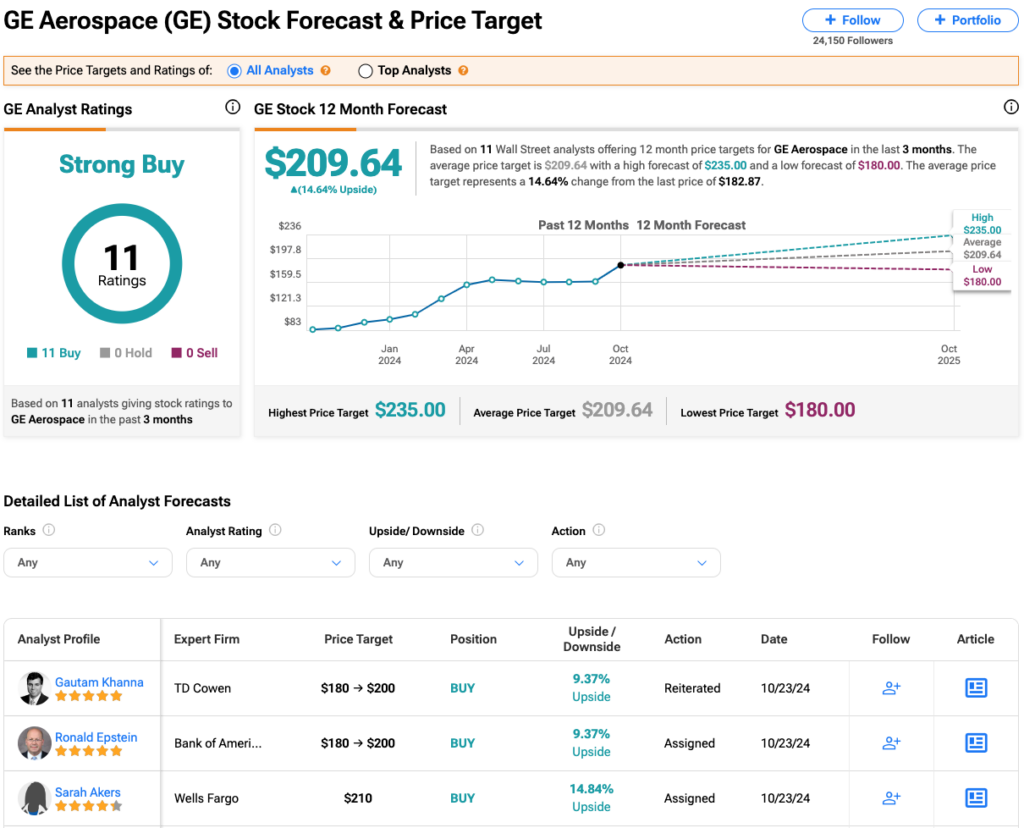

Of these three aerospace stocks, only GE holds a Strong Buy Consensus from Wall Street. It currently has 11 Buy ratings, with no Holds or Sells issued over the past three months. The average GE stock price target of $209.64 represents a 14.64% change from the last price of $182.87.

By contrast, both Lockheed Martin and RTX both hold a Moderate Buy Consensus. For LMT, that is based on 9 Buys, five Holds and one Sell over the past three months, while RTX currently has six Buys, eight Holds and zero Sells.

While GE stock is the highest rated of the three, Wall Street is clearly optimistic that all three aerospace stocks will continue to grow throughout the coming months.