The Valens Company (VLNS) shares soared 7% in early trading Tuesday after the Canadian pot producer announced that it has entered into an agreement to acquire Green Roads and its majority-owned manufacturing subsidiary in a transaction potentially valued at $60 million. The price consists of $40 million, plus contingent consideration of up to $20 million payable when the business reaches certain EBITDA milestones.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

This acquisition gives The Valens Company immediate entry into the US market with a leading CBD health and wellness brand with an established manufacturing and distribution platform. Florida-based Green Roads is the largest private CBD company in the United States.

Green Roads has an extensive distribution network of over 7,000 retail stores as well as an e-commerce and marketing platform with over 30,000 five-star reviews.

The Valens Company CEO, Co-Founder, and Chair Tyler Robson said, “The acquisition of Green Roads represents only the first step in our US expansion strategy as we expect to continue to unlock complimentary, revenue-generating opportunities while we forge our presence and build our reputation in the world’s largest cannabinoid market. Together, The Valens Company and Green Roads make a formidable team, and the combined entity will be primed for significant growth as the global market develops.”

It is expected that the deal will close in June and be accretive to earnings in 2021. (See The Valens stock analysis on TipRanks)

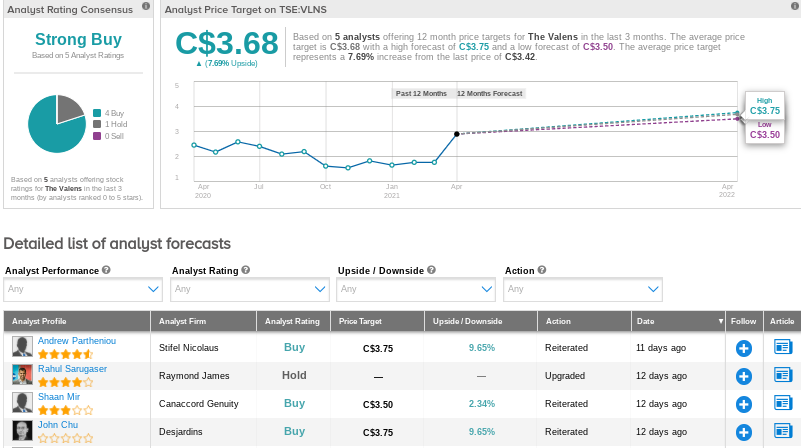

Two weeks ago, Desjardins analyst John Chu maintained a Buy rating on the stock with a price target of $3.02 (C$3.75) for a 6.8% upside potential.

Chu said in a note, “We are encouraged that Valens was able to post a solid 1Q despite industry headwinds which caused many of its peers to recently post lower-than-expected revenue. And with several upcoming sales drivers, we have increased comfort that Valens should continue to generate strong sales growth going forward despite ongoing industry headwinds. Valens continues to be well-positioned in the cannabis 2.0 market and should remain a standout in both uncertain and more normalized market conditions.”

Overall, the consensus is that VLNS is a Strong Buy, based on 4 Buys and 1 Hold. The average analyst price target of C$3.68 implies an upside potential of about 8% from current levels. Shares have more than doubled in valued year-to-date.

Related News:

Fire & Flower Revenue Rises 147% in 4Q; Shares Pop 8%

Canadian National Railway Misses On Revenue In 1Q

CareRx Enters Deal With Rexall To Add 4,200 Beds