While much of Paramount’s (PARA) rank-and-file is likely holding its collective breath for the next few weeks, wondering if the axe will fall on their division next, reports from Deadline note that one division was mostly unscathed. Some may be surprised to hear which division it was. This mercy has done Paramount few favors, as the media giant’s shares are down fractionally in Wednesday afternoon’s trading.

The division that is mostly getting off scot-free is CBS Sports. CBS Sports’ CEO, David Berson, noted that while Paramount may be laying off 15% of its total workforce, that is not putting much of a crimp in CBS Sports’ style or its overall operations. Berson noted that the “…sports world is growing in value every single day.”

That is actually true, for the most part; all anyone needs to do to confirm this is look at Warner Bros. Discovery’s (WBD) active pursuit of the National Basketball Association (NBA). Still, Berson made it clear that while “…every group’s impacted…,” CBS Sports remains “…largely intact.” Berson summed up with one key observation: “…we’re in a really strong position in a really strong category.”

Potential Internal Drama Afoot

Amid all the layoffs and merger talks, it seems like Paramount may potentially add to the drama. Indeed, Jeff Shell, who is set to become president once the merger is complete, is something of a controversial figure. According to Deadline, Shell left NBCU (CMCSA) back in April 2023 following a report of “inappropriate conduct” by anchor Hadley Gamble. However, those same reports noted that investigations followed the allegations and ultimately went nowhere.

Is Paramount Stock a Good Buy?

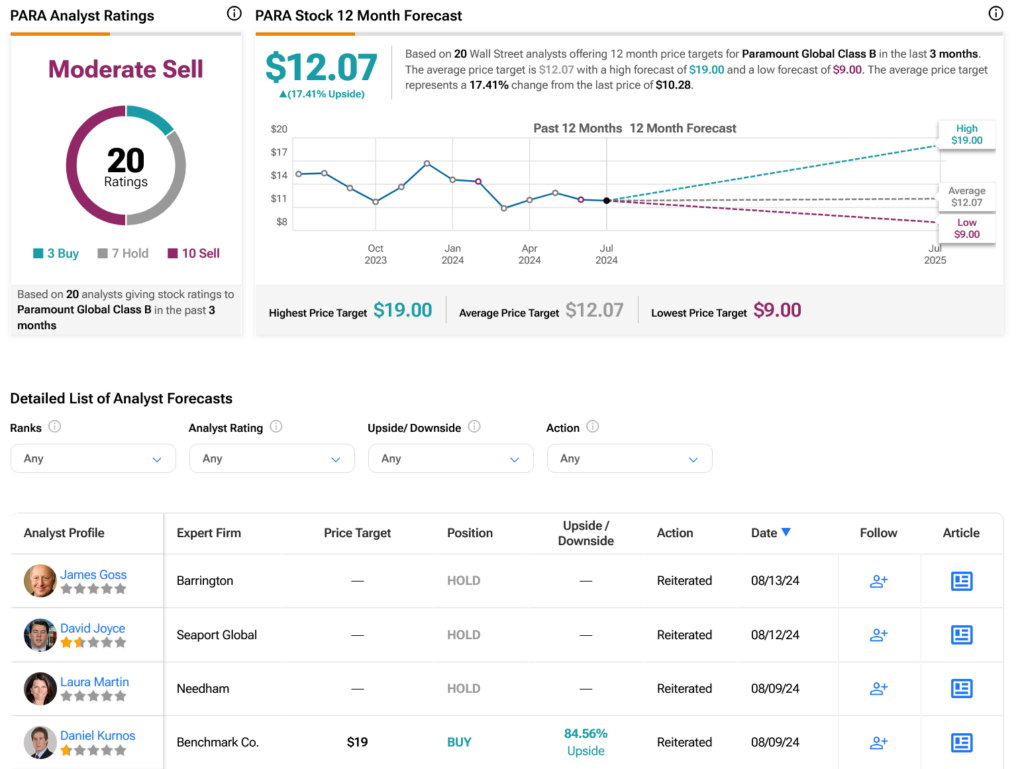

Turning to Wall Street, analysts have a Moderate Sell consensus rating on PARA stock based on three Buys, seven Holds, and 10 Sells assigned in the past three months, as indicated by the graphic below. After a 31.91% loss in its share price over the past year, the average PARA price target of $12.07 per share implies 17.41% upside potential.