The bullishness for artificial intelligence (AI) investments has been centered on large tech companies like Nvidia (NASDAQ:NVDA) and Microsoft (NASDAQ:MSFT), as well as smaller ones like SoundHound AI (NASDAQ:SOUN). A growing number of investors and analysts are now opening their eyes to a broader perspective. They suggest that companies adopting AI to transform their business operations could be the next big gainers. At the heart of this shift is the potential for significant productivity gains and efficiency improvements across various industries. This is the natural next step in the AI revolution.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Shift in Investment Focus

Caroline Pötsch-Hennig, who leads JPMorgan’s (NYSE:JPM) private bank in Germany, says it’s now important to shift investment focus and start looking beyond chipmakers and cloud computing providers. She said it’s unwise to stay aimed only at “chipmakers or cloud computing providers that are facilitating the creation of new AI models.” Instead, she suggests that investors should also consider companies that are adopting AI to transform their business operations.

Productivity Gains and Efficiency Improvements

AI is not just about the whiz-bang advancements in tech; its main function is to create productivity gains and efficiency improvements. Clare Pleydell-Bouverie, a portfolio manager at Liontrust Asset Management (GB:LIO), highlighted that AI is set to remove “a lot of waste out of people’s jobs” and bring about a “phenomenal productivity uplift.” This efficiency gain is evident in companies like JPMorgan Chase, which can reportedly cut manual work by 90% with an AI-powered cash flow management tool.

JPMorgan’s AI Initiatives

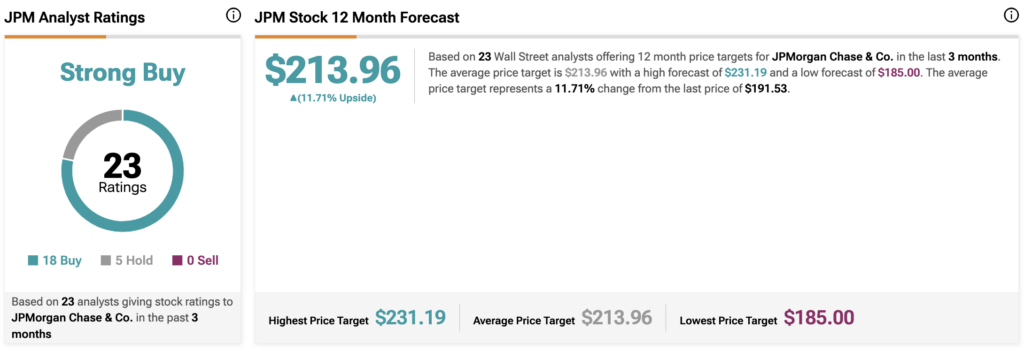

America’s largest bank, JPMorgan, is also developing a ChatGPT-like AI-powered software service called IndexGPT to tailor securities according to customers’ needs. The bank’s shares have risen around 15% year-to-date and almost 40% over the last 12 months. The bank has earned a Strong Buy rating on TipRanks, with 18 out of 23 analysts covering the stock giving it a Buy rating, with an average price target of $213.96, indicating a potential upside of around 11.7%.

Consumer-Facing Companies and AI Adoption

Consumer-facing companies are also expected to benefit significantly from AI adoption. L’Oréal (OTC:LRLCY), the French beauty and cosmetics giant, has pioneered beauty tech with its generative AI beauty assistant system, Beauty Genius. This AI-powered product can respond to questions, create personalized routines, and recommend products based on users’ preferences. What’s more, L’Oréal’s AI system has a 60% higher customer conversion rate than in-store advisors.

Key Takeaway

The next wave of AI beneficiaries could be companies across various sectors that are adopting AI to transform their business operations. These companies are poised to benefit from significant productivity gains, efficiency improvements, and increased customer engagement.