And so, it begins. The long-awaited 20-hour grilling of aerospace company Boeing (BA) by regulators has begun, and it will likely generate at least some new answers about what happened back on January 5 when a piece of Boeing’s plane fell off mid-flight. Meanwhile, Boeing shares were down fractionally as investors did not particularly like where this was going.

Boeing faced down the assembled might of the National Transportation Safety Board (NTSB), investigating the door panel failure aboard an Alaska Airlines (ALK) flight. That was what, in many ways, kicked off a litany of mechanical failures and other issues for Boeing. But the NTSB did not just go after Boeing; it went after the Federal Aviation Administration (FAA) as well.

NTSB chair Jennifer Homendy noted that there were issues of “missing and incorrect documents” going back years. “This is not new,” Homendy declared, wondering why the FAA didn’t step in earlier to address Boeing’s shortcomings. While the FAA admitted to being “too hands-off” when it came to Boeing oversight, focusing on paperwork more than physical inspections, the FAA did move to limit Boeing’s production while it came up with plans to improve.

Another Problem for Kelly Ortberg

While new CEO Kelly Ortberg definitely has a major problem addressing Boeing’s quality issues, it is not the only problem he has. One of the biggest problems he has is addressing Boeing’s ailing finances. The latest earnings report saw Boeing post a loss of $2.90 per share. That’s well beyond what analysts expected, and that kind of loss is not sustainable for long.

Worse, it remains clear that Boeing’s stock is a poor performer right now. Reports place it as one of the S&P 500’s 10 worst-performing stocks, and if it were not for the fact that Boeing is part of essentially a duopoly with Airbus (EADSY), the end result would have been even greater losses.

What Is the Prediction for Boeing Stock?

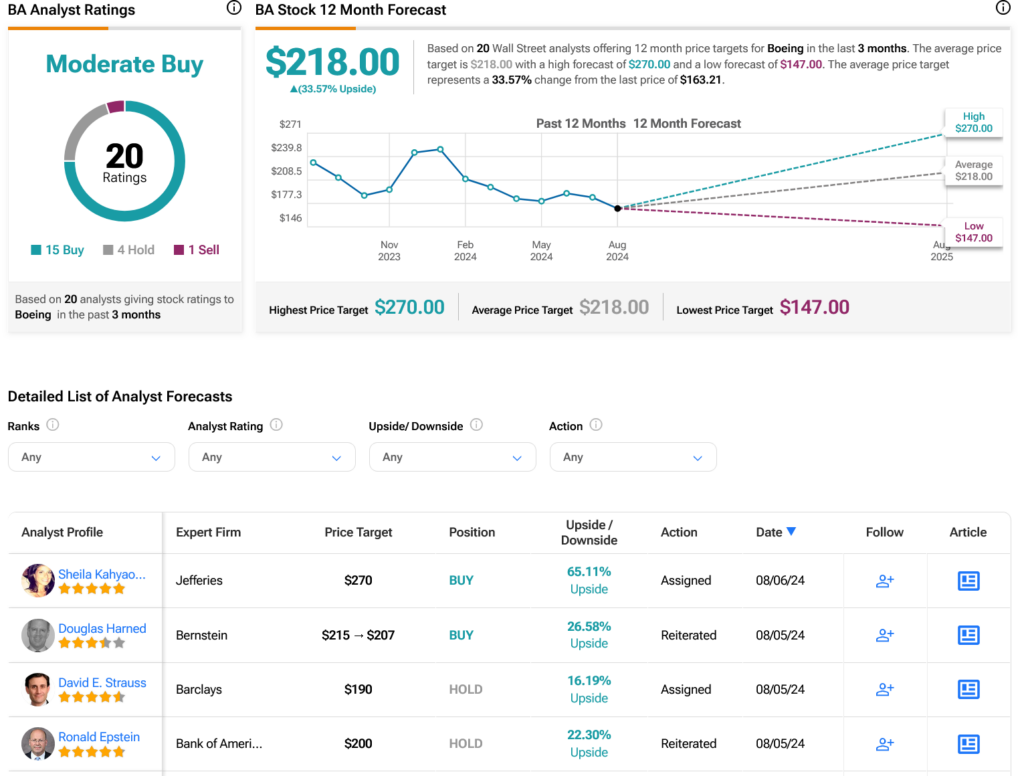

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 15 Buys, four Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 31.3% loss in its share price over the past year, the average BA price target of $218 per share implies 33.57% upside potential.