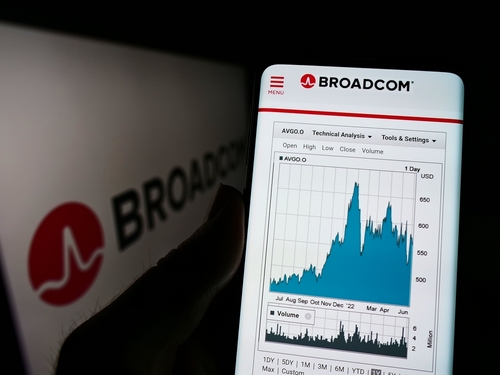

Pre-earnings options volume in Broadcom (AVGO) is 1.5x normal with calls leading puts 2:1. Implied volatility suggests the market is anticipating a move near 6.7%, or $11.98, after results are released. Median move over the past eight quarters is 5.6%.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Published first on TheFly – the ultimate source for real-time, market-moving breaking financial news. Try Now>>

Read More on AVGO:

- Options Volatility and Implied Earnings Moves Today, December 12, 2024

- S&P 500 Rockets Higher on November Inflation Data

- Broadcom Stock Soars on Report Its Helping Apple Develop an AI Chip

- Early notable gainers among liquid option names on December 11th

- Apple, Broadcom working on AI chip, The Information reports