Regardless of how one feels about former president Donald J. Trump, there’s no denying that Trump Media & Technology Group (DJT)—the company behind the Truth Social platform—enjoys strong grassroots support. Despite volatility in the share price during the current U.S. presidential election campaign and a lack of profitability at the company, one shouldn’t underestimate the power of Trump Media. While I am personally neutral on DJT stock, I see an opportunity for investors to make some quick profits through the trading of options.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The Pros and Cons of DJT Stock

Although I’m neutral on this stock, Donald Trump enjoys strong support among his core base of voters. Those supporters will bid up DJT stock irrespective of the underlying business and financials. In the midst of the current election cycle, and with Trump vowing not to sell his own holdings of the stock, investor sentiment towards Trump Media remains robust. That said, in this year’s second quarter, the company behind the Truth Social app, which is based on X/Twitter, generated less than $837,000 in revenue.

Trump Media’s Q2 net loss came in at $368 million. The poor financial performance has led to extreme volatility and big price swings in DJT stock in recent weeks. Over the past month, the share price has declined 25%. At its current share price of $17, the stock is down 74% since it went public in late March of this year. While the volatility and performance of the stock might turn off some investors, there is a way to profit from this security using a carefully structured options trade.

Wheel of Options

Despite my neutral view, I believe investors can profit from DJT stock by employing a wheel of options approach that consists of three stages of bullish and bearish trades separated by a median category.

Simply buying put or call options on DJT stock doesn’t make much sense. This is because the stock has lost almost 50% of its equity value in the last six months. Simultaneously, DJT can deliver blistering rallies that materialize seemingly out of nowhere. The stock’s unpredictable nature makes me weary of undertaking even moderately bullish or bearish trades.

That leaves three approaches: lean bullish, lean bearish, or purely neutral. Given the close presidential election campaign that’s underway, there’s a likelihood that shares of DJT could move higher in the near term. From a tactical perspective, a trade that leans bullish might be the prudent approach.

Setting Up a Bull Put Spread

To potentially profit from a neutral to slightly bullish thesis, investors should choose a bull put spread strategy. A put spread falls under the category of options trades known as “vertical spreads.” Investors generate income from a sold put and cap off this contract’s liability with a bought put of the same expiration date.

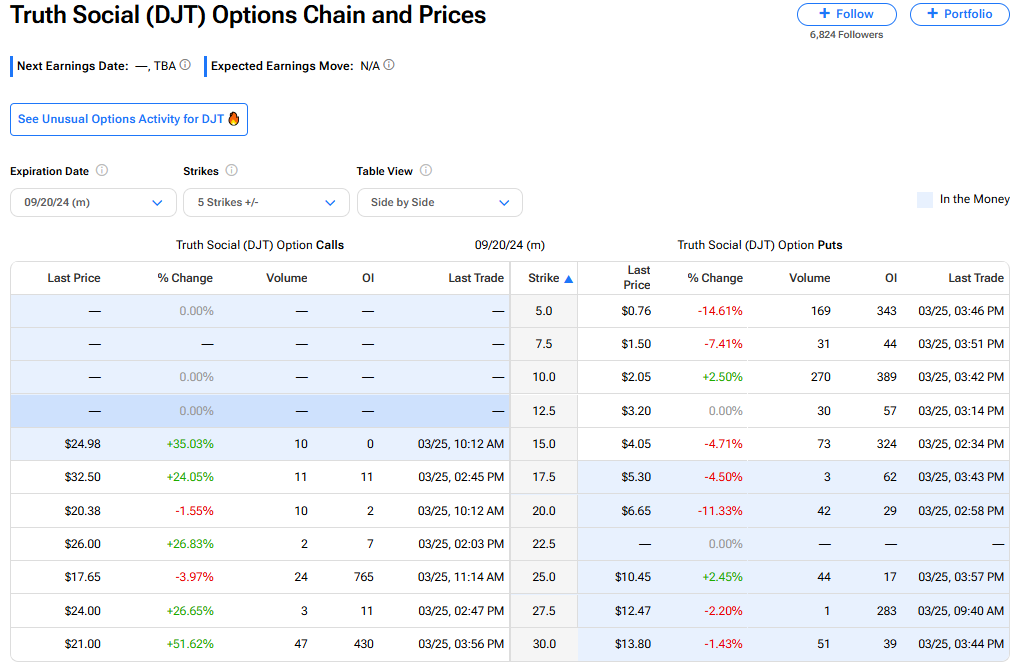

Investors have many options to choose from. However, the trade that offers an ideal risk-reward balance is the transaction involving puts expiring on Sept. 27 of this year. Traders can sell the $14.50 put and purchase the $12.50 put for $1.16 and $0.76, respectively, at the time of writing.

As a result, The maximum profit that can be generated from this trade is $0.40 per contract (or $40 after multiplying 100 shares). On the other hand, the maximum loss comes in at $1.60 per contract (or $160 per 100 shares), providing a risk-reward ratio of 4-to-1.

Dissecting the Trump Media Trade

For the above trade to be profitable, DJT stock must stay above the breakeven price of $14.10. Ideally, DJT stock will stay above the sold put’s strike price of $14.50. At that point, both puts will expire worthless. However, with the investor already receiving a credit of $0.40 per contract, both options expiring worthless is an ideal outcome.

On the other end, let’s suppose that DJT stock suffered a catastrophic loss of value. Because an investor sold a put, they would be obligated to fulfill the terms of the contract when the other party exercises the option. The good news here is that the liability is capped thanks to the put bought with a strike price of $12.50. Deploying a bull put spread yields limited rewards. However, this strategy also limits downside risk, making it a powerful weapon in an investor’s trading arsenal.

Is DJT Stock a Buy?

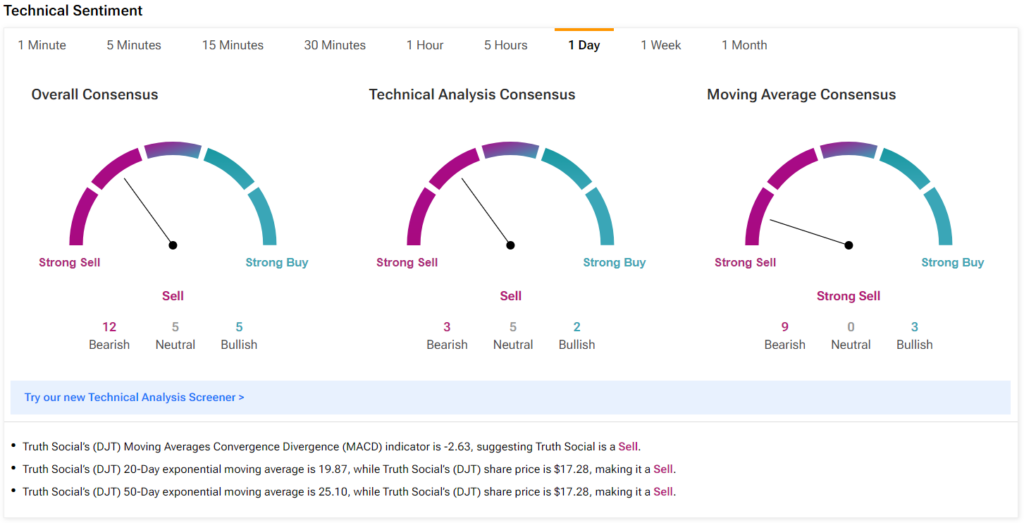

Using TipRanks’ technical analysis tool, the indicators seem to point to a positive outlook. Indeed, the summary section pictured below shows that 16 indicators are Bullish, compared to one Neutral and five Bearish indicators.

See more DJT technical analysis

Conclusion: Use Options to Trade Unpredictable DJT Stock

Given its poor financials and association with former President Trump, the stock of Trump Media & Technology Group is likely to remain volatile and a risky investment. As such, a bull put spread may be the best approach as it enables investors to win from sideways consolidation or a move higher in the share price. This option trade also limits downside risk for investors, which is important.