Target Corp. (TGT) rallied in pre-market trading after robust Q2 results and an improved outlook. The retailing giant reported adjusted earnings of $2.57 for the second quarter, up by 40% year-over-year, exceeding analysts’ expectations of $2.19 per share.

Furthermore, the company generated total revenues of $25.5 billion in the second quarter, an increase of 2.7% year-over-year, surpassing consensus estimates of $25.2 billion. TGT’s comparable sales rose by 2% in the second quarter, which was at the high end of the company’s expectations.

Target CEO Spotlights Growth Drivers

In light of these strong results, Brian Cornell, Chair and CEO of Target commented, “Our growth was driven entirely by traffic in stores and our digital channels, with double-digit growth in our same-day delivery services.” He added that the retailer was observing improving trends in its discretionary categories, especially in apparel, with ongoing strength in beauty.

Target Pays Increasing Dividends to Shareholders

Moving on to shareholder returns, the retailer paid $509 million in dividends in the second quarter, with its dividend per share increasing by 1.9% year-over-year. It also repurchased $155 million worth of shares in Q2, retiring 1.1 million shares at an average price of $145.94. Consequently, at the end of the second quarter, Target had $9.5 billion remaining under its share repurchase program.

TGT’s Raises Q3 and FY24 Guidance

Looking ahead, for the third quarter, TGT expects comparable sales to increase in the range of 0 to 2%, with adjusted earnings likely to be between $2.10 and $2.40 per share. In addition, for FY24, TGT is maintaining its comparable sales forecast within the same 0 to 2% range but now anticipates this growth to fall in the lower half of that range.

Given the strong profit performance in the first half of the year, the retailer has raised its FY24 adjusted EPS forecast to between $9.00 and $9.70, up from the previous outlook of $8.60 to $9.60 per share. For context, analysts have projected its Q3 and FY24 earnings to be $2.24 and $9.22 per share, respectively.

What Is the Future of TGT Stock?

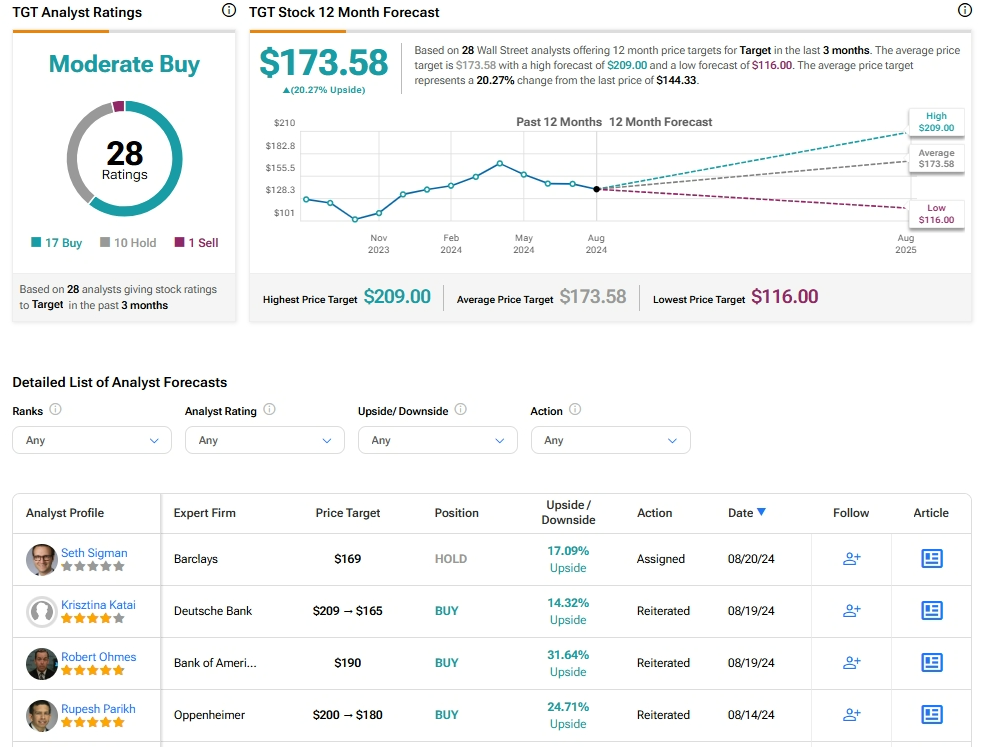

Analysts remain cautiously optimistic about TGT stock, with a Moderate Buy consensus rating based on 17 Buys, 10 Holds, and one Sell. Over the past year, TGT has increased by more than 15%, and the average TGT price target of $173.58 implies an upside potential of 20.3% from current levels. These analyst ratings are likely to change following TGT’s results today.