Teva Pharmaceutical (TEVA) has partnered with Bioeq for the commercialization of a biosimilar candidate to Lucentis. Swiss company Bioeq is developing a Lucentis alternative, or biosimilar, called FYB201. It obtained exclusive commercialize rights to the drug from German company Formycon.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Teva and Bioeq have agreed to work together to bring FYB201 to market. They are targeting its sale in Israel, Canada, Europe, and New Zealand.

Sven Dethlefs, Teva’s Executive Vice President, Global Marketing & Portfolio and International Markets Commercial, said, “Unlocking the value of biologics with biosimilars is an important new frontier in drug development that offers patients safe and effective treatment options through more affordable alternatives to branded biological products that have lost their exclusivity rights.”

The arrangement involves Bioeq working on the drug’s development, registration, and supply. For its part, Israel-based Teva will handle its commercialization. The companies plan to share the revenue from FYB201 sales. But they have not disclosed the financial terms of the partnership or the product details.

Biosimilar drugs are intended to expand patient’s access to treatments for chronic or life-threatening diseases at a reduced cost of medication compared to branded biologics. Teva says the partnership with Bioeq expands its biosimilar portfolio and shows its commitment to expanding access to quality medications. (See Teva stock chart on TipRanks).

Raymond James analyst Elliot Wilbur recently initiated coverage on Teva stock with a Buy rating without assigning a price target. Focusing on the generic challenges to Teva’s Austedo drug, the analyst observed that generic competition is still many years away, maybe 2026 at the earliest.

Wilbur told investors, “The product generated $146M in net sales during 1Q21, and management expects 2021 sales to be approximately $950M…We estimate Austedo is annualizing in the $725.0 – $750.0M range. A recently initiated DTC advertising campaign is anticipated to reaccelerate RX trends in 2H21.”

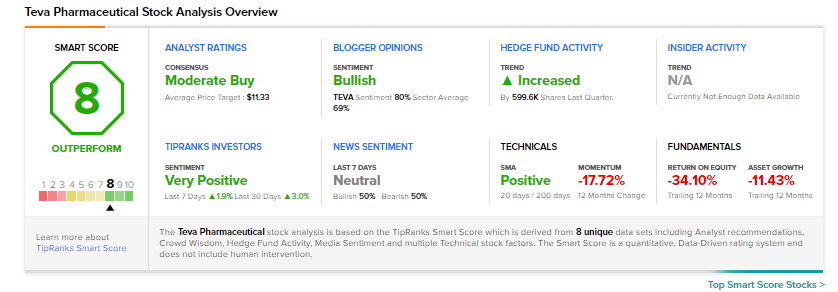

Consensus among analysts is a Moderate Buy based on 2 Buys and 3 Holds. The average Teva price target of $11.33 implies 12.96% upside potential to current levels.

TEVA scores an 8 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Alphabet’s Wing Releases Drone Airspace Access App

Walmart Launches Its Own Insulin Brand

Sony Snaps up Housemarque Studios