EV maker Tesla (NASDAQ: TSLA) once again hit headlines amid speculations over supply issues to disrupt production. A spokesperson for the company has put an end to rumors, saying that the output at its Shanghai factory has not been halted, Bloomberg reported.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

It was speculated that Tesla had halted most of its production at its Shanghai plant, as reported by Reuters. This was supposedly due to logistic challenges followed by a prolonged COVID-19 lockdown in China.

According to the unidentified person, workshops at the company’s China plant were operating until now, however, the factory may halt production later this week due to logistical issues.

Shares of the company closed more than 9% lower on Monday, although the broader market itself had a rather rough day.

Background

Tesla suspended production at its Shanghai gigafactory for three weeks in April following the announcement of a two-stage COVID-19 lockdown in China to curb the new variant spread. Later that month, more than 80% of production was resumed at Tesla’s China factory.

Tesla is on the whitelist of companies permitted to resume work in Shanghai, granted it remains in a “closed-loop system.” It indicated that employees were staying on the premises and were not allowed to go out.

According to the report, around 10,000 vehicles were produced from the Shanghai plant between April 19 and April 30, representing a run rate of about 830 cars per day.

Analyst Recommendations

Recently, Morgan Stanley analyst Adam Jonas reiterated a Buy rating and a price target of $1,300 (65.16% upside potential) on Tesla.

In his report, Jonas wrote, “We recently reiterated our $1,300 price target on Tesla driven by increased valuation support from the company’s energy/battery/EV infrastructure leadership across its portfolio.”

The rest of the Street is cautiously optimistic about the stock, which has a Moderate Buy consensus rating based on 14 Buys, eight Holds, and five Sells. The average Tesla price target of $980.41 implies a 24.56% upside potential. Shares have gained 25.13% over the past year.

Bloggers Weigh in

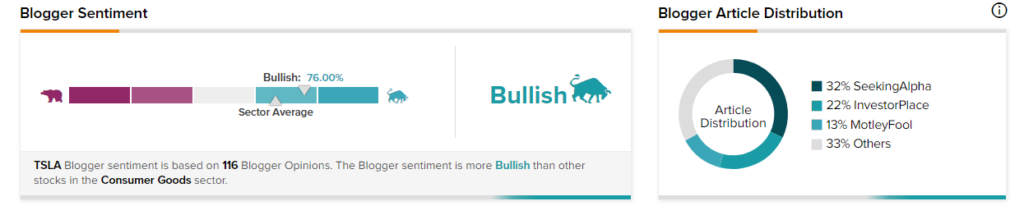

Bloggers seem enthused by the company’s developments. TipRanks data shows that financial blogger opinions are 76% Bullish on TSLA, compared to a sector average of 67%.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure

Related News:

Lucid Announces Higher Pricing, Posts Narrower Quarterly Loss

Nikola: Lower-than-Expected Q1 Loss; What’s Next?

Amarin Nosedives on Disappointing Quarterly Results