Supply-chain disruptions and battery cell manufacturing challenges are making it hard for Tesla (TSLA) to ramp up production at its gigantic factories. Chief Executive Officer (CEO) Elon Musk is on record admitting they are unable to increase output due to the persistent headwinds. Likewise, according to the Wall Street Journal, the electric vehicle (EV) giant is on course to post its first quarter-over-quarter decline in deliveries in more than two years due to production challenges.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Lower Q2 Deliveries

Analysts expect Tesla to deliver 273,000 vehicles in the second quarter, down from the 310,000 delivered in the year’s first three months. The reduced deliveries were revealed after Musk admitted in an interview with the Tesla owners’ club that factories in Germany and Texas have become money furnaces.

According to Musk, the Berlin and Houston plants are losing billions of dollars in expenses while not churning out as many cars as expected. The admission does not come as a surprise, as the car-making business is a cash-intensive process. Tesla has seen its balance sheet take a hit from ramping up investments in new factories. It spent $11 billion in the first quarter to purchase items needed to produce and sell cars.

Tesla’s Production Challenges

Meanwhile, the automaker plans to suspend production at its plant in Shanghai, China, for the first two weeks of early next month. Reuters reports the move will allow the company to carry out upgrade work at the site. After the upgrade, Tesla plans to boost production to a new record high of 22,000 per week, up from the current production of 17,000 Model 3 and Model Y cars weekly.

However, production at the Chinese factory is on course to fall by over one-third in the second quarter. Lockdowns in China to combat COVID-19 also affected production significantly. Higher supplier and logistics costs in the recent quarter amid soaring inflation have also made it difficult for the company to ramp up production. Musk has also admitted that raw material constraints are hindering any push to scale production.

Ramping up output for the newly launched Model Y sport utility car is already a challenge due to battery supply bottlenecks. Due to the production hiccups, Model Y deliveries in Australia have been pushed to the first quarter of 2023. Customers in Europe have to wait until the fourth quarter, while buyers in China have to wait up to 24 weeks.

Tesla has started producing more giant battery cells in-house after relying on finger-sized batteries made by other companies in the past. Producing batteries in-house is part of the company’s push to reduce the cost of the key component and address battery shortages that have affected production.

Wall Street’s Take

Morgan Stanley analyst Adam Jonas has reiterated a Buy rating on the stock and lowered the price target to $1,200 from $1,300, implying 69.43% upside potential from current levels. According to the analyst, Tesla’s Q2 EV volume will come in at 270,000 units, down from an initial forecast of 316,000 units. The analyst has also lowered his full-year EV volume to 1.39 units from 1.425 units.

The Street is optimistic about the stock, with a Moderate Buy consensus rating, based on 16 Buys, eight Holds, and six Sells. The average Tesla price target of $913.66 implies 29% upside potential from current levels.

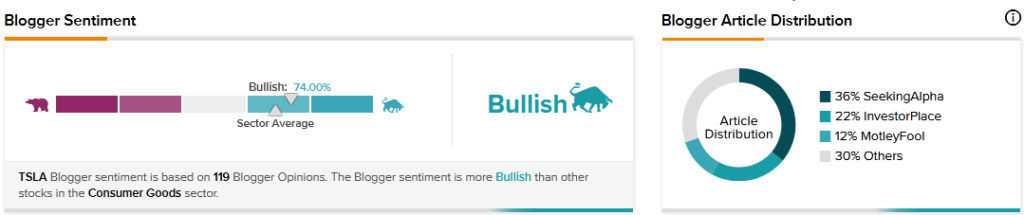

Blogger Opinions

TipRanks data shows that financial bloggers’ opinions are 74% Bullish on TSLA compared to a sector average of 69%.

Key Takeaway for Investors

Tesla is facing its biggest test amid the production issues triggered by supply chain issues and higher costs of raw materials. With the company on course for its first quarter-over-quarter decline in deliveries amid increased investments in the production chain, the rate of profit growth could take a hit.