Tesla’s (NASDAQ:TSLA) recent report of better-than-expected vehicle deliveries has caused significant losses for traders betting against the company. The EV maker’s stock has surged 17% in two days since the report, which has resulted in short sellers losing an estimated $3.5 billion, according to S3 Partners. As a result, short interest currently stands at 3.5% of the float, with the 97 million shares shorted valued at $22.4 billion.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Unsurprisingly, Tesla CEO Elon Musk, who is a known hater of short-sellers, celebrated their losses. This included throwing a jab at Bill Gates, who himself is a Tesla short-seller. More specifically, he said that anyone betting against Tesla will be “obliterated” once it solves autonomous driving and has “Optimus in volume production.”

However, it’ll be interesting to see how Tesla’s core business performs going forward as economic conditions continue to slow down. Although the firm’s second-quarter deliveries of 443,956 beat Wall Street estimates of 439,000, it still represented a 4.8% decline year-over-year. In fact, Tesla has been offering discounts and low-interest financing, along with other perks, in order to improve sales amid an aging lineup and increased competition.

Is Tesla a Buy or Sell?

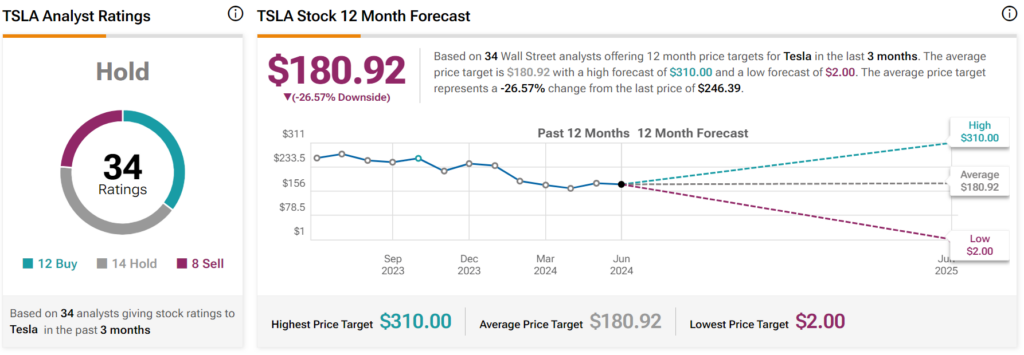

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 12 Buys, 14 Holds, and eight Sells assigned in the past three months. Tesla’s stock has surged significantly since its low in April and has nearly recovered all of its losses for the year. As a result, the average TSLA price target of $180.92 implies a downside potential of 26.57% from current levels.